Microfinance sector remains strong—RBM

The country’s microfinance sector continues to remain strong in terms of profit, capital and liquidity despite being hit by non-performing loans (NPLs), according to the Reserve Bank of Malawi (RBM) 2017 Financial Stability Report.

In absolute terms, NPLs for the sector stood at K414.9 million as at the end of September 2017 from K621 million in March 2017 while NPLs to gross loans for non-deposit taking sector increased to 16.5 percent from 12.1 percent during the same period due to decrease in gross loans.

But despite the rising NPLs, the sector recorded sufficient capital and an improvement in profitability.

The sector’s profitability improved, posting a profit after-tax of K475.3 million in September 2017 from a loss of K528.4 million in March 2017.

Capital level remained satisfactory during the reviewed period as all institutions met the minimum regulatory requirement, according to the report.

“Both Tier 1 and total capital ratios for deposit taking microfinance institutions stood at 22.6 percent as at end September 2017 from 21.3 percent in March 2017. The ratios were above the recommended regulatory benchmarks of 10 and 15 percent, respectively,” reads the report in part.

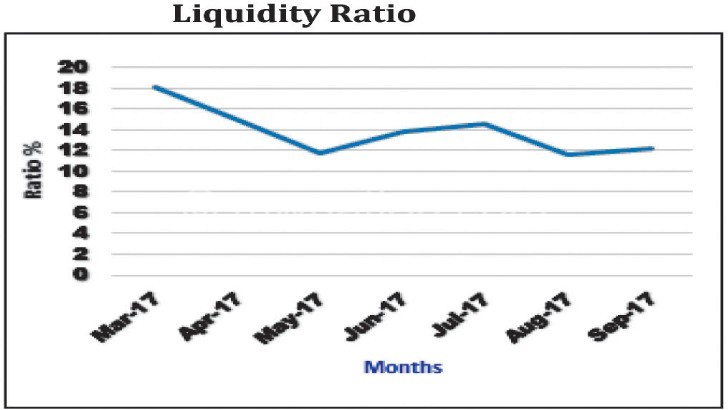

On the other hand, liquidity ratio at 40 percent as at end of September 2017 from 50.7 percent as at March 2017 was also above the recommended benchmark of 20 percent.

Malawi Union of Savings and Credit Cooperatives (Muscco) corporate affairs and member relations executive Tawina Maness Chinoko, in a written response to a questionnaire, attributed the good performance of Saccos to various initiatives undertaken to improve their performance.

She said in the just ended year, performance of Saccos has been good with almost all Saccos posting profits.

“This year and going forward, Saccos are poised to continue to perform even better financially, with a lot of Saccos maintaining the momentum, as they plan to double their membership so that more Malawians should utilise Sacco services,” said Chinoko.

She said Muscco is leading the Sacco fraternity to engage various institutions and communities to either form or join existing Saccos so that most Malawians should build domestic savings base for sustainable socio economic development.

Said Chinoko: “We envisage a future where each and every institution will have a Sacco of its own or its employees linked to existing Saccos of their choice.

“To this effect we are also collaborating with the Reserve Bank of Malawi in an intensive Sacco membership mobilisation and retention drive.” n