T-bills issuance key to easing public debt A

Chancellor College economics professor Ben Kaluwa and a local market analyst Cosmas Chigwe have described government’s move to issue treasury securities for the 2017/18 fiscal year as a stepping stone towards easing huge public debt.

Over the years, the country’s gross public debt has increased largely due to huge budget deficits which compel government to borrow on the domestic market to finance the gap.

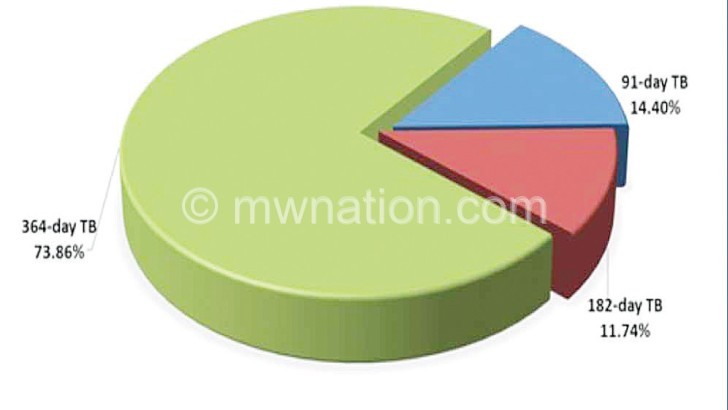

But in its quest to strengthen debt management practices through adherence to public debt policies and medium-term debt strategies, government has issued the calendar for Treasury bills (T-bills) for the remainder of 2017/18 fiscal year.

In an interview on Tuesday, Kaluwa said government efforts to stabilise the economy cannot go unnoticed, adding that the central government seems to be more strategic now.

“Government should speak to budget and such calendars so that we will not have such things as budgetary deficits that unexpectedly corner us.

“We want things like these periodically so that expectations are met. We do not want to be taken by surprise,” he said.

Kaluwa said other than demonstrating efforts to ease public debt burden, government has also done a commendable job by prioritising skills development by allocating more funds to the education sector other than the agriculture sector as it used to be the case previously.

For his part, Chigwe said the issuance of T-bills notes mostly as a means of debt restructuring by converting short-term securities into longer dated ones, is one sure way to ease debt burden.

He said along with this, the gradual resumption of budget support has an advantage of easing domestic debt burden on government.

During the 2017/18 budget presentation, Minister of Finance, Economic Planning and Development Goodall Gondwe said part of the budget support will be used to pay off outstanding domestic debt and arrears.

“Much of the seemingly improved government fiscal management is due to pressure from the International Monetary Fund [IMF] which has kept government on a rather tight leash by tying the Extended Credit Facility [ECF] carrot to improvements in fiscalmanagemne management,” he said. n