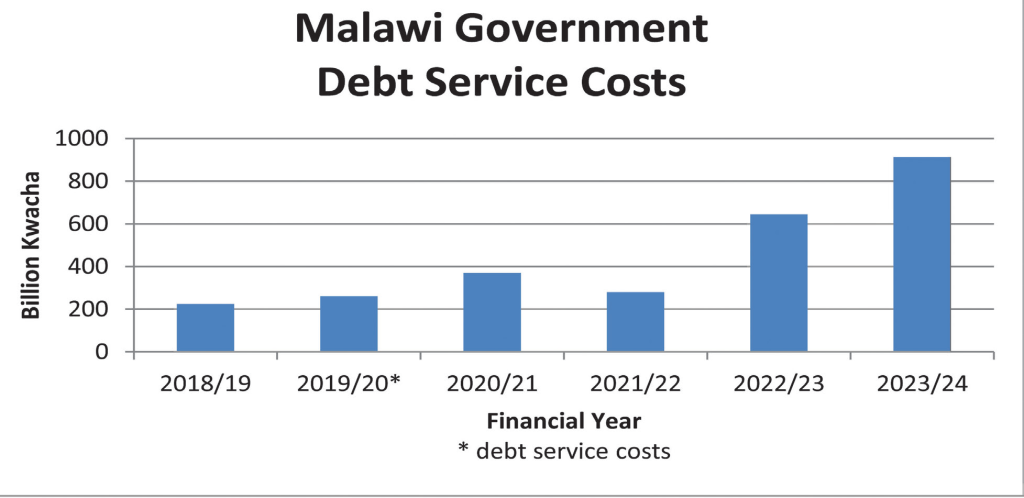

Debt charges choke budget operations

The Malawi Government continues to pay more to service its public debt, living little room for Treasury to deal with other economic challenges.

In the five years to the 2023/24 financial year, for instance, Treasury will have paid an accumulated K2.2 trillion in debt service, which is the amount needed to repay the principal and interest on a debt.

In the 2019/20 financial year, Treasury paid K261 billion in debt service charges, but this is expected to increase to K914 billion at the end of the 2023/24 financial year.

However, during the review period, fiscal deficit has risen from K162 billion in the 2019/20 financial year and is projected to rise to K1.3 trillion in the 2023/24 financial year.

Despite development expenditure increasing from K438 billion in 2019/20 financial year to K896 billion in the 2023/24 financial year, as a percentage of the total budget, it has declined from 25.3 percent to 23.1 percent.

However, development expenditure has still relied on foreign resources.

Speaking in an interview on Tuesday, Malawi University of Business and Applied Sciences economics professor Betchani Tchereni observed that government has a thin resource envelope most of which is being channelled towards meeting debt obligations.

He said: “Government is a going concern, meaning that it doesn’t matter which political party is in power. At this stage, government has a number of debt obligations which are maturing.

“And so, government must pay back those debts. Some of them were obtained several years back, even 10 or so years back, but they were borrowed by Government of Malawi, and so Government of Malawi, regardless of who is in power must pay.”

As at end December 2022, total public debt reached K7.9 trillion, representing 69.93 percent of the gross domestic product (GDP) pegged at K12 trillion.

Out of this stock, K4.43 trillion is domestic debt, which is 114 percent of the total budget while K3.47 trillion is external debt, an equivalent of 90 percent of the total budget.

Treasury admits that the current composition of the country’s public debt is prone to a number of risk factors with K1.18 trillion or 18.3 percent of public debt (equivalent to 10.3 percent of GDP) is maturing in 2022/23 financial year.

With such magnitudes of debt maturing in one financial year, Treasury confirms fears that Malawi’s refinancing and interest rate risks are relatively high as, beyond the 2022/23 financial year, the redemption profile also indicates maturity spikes on domestic debt, manifesting high debt service payments in the years up to 2027.

These amounts will grow with the expected additional issuance of relatively short and medium-term securities, namely Treasury bills and two-year and three-year Treasury notes.

Speaking separately, economist Gilbert Kachamba said that the rising debt charges is an indication of an economy which is taking on too much debt relative to its revenue streams, or when interest rates on existing debt rise.

He said this means that the country may have to divert funds that would otherwise be used for development projects or social programmes towards debt repayment.

Said Kachamba: “A high debt service ratio can limit a country’s ability to invest in key areas which can slow economic growth and reduce the overall quality of life for citizens.

“Secondly, a high debt service ratio can make it more difficult for a country to obtain new financing which can further limit a country’s ability to finance new development initiatives and can create a cycle of debt that is difficult to break.”

He further said a high debt service ratio can make a country more vulnerable to economic shocks and make it more difficult to respond to economic challenges, leading to a protracted period of economic hardship.

The draft 2023/24 financial statement shows that the World Bank, through the International Development Association, remains the largest creditor constituting 47.61 percent of the external debt stock seconded by the African Development Bank, through the African Development Fund at 16.1 percent and thirdly the Export-Import Bank of China with a share of 8.34 percent.

The statement indicates that over 80 percent of the external debt is concessional, 13 percent is semi concessional loans while 5.67 percent are commercial loans.

In terms of domestic debt, it has increased over the past years both in nominal terms as a share of total public debt and as a percentage of GDP.

The domestic debt stock has increased from K1.5 trillion or 42.1 percent of total public debt and 20 percent of GDP at the end of the 2018/2019 financial year to K3.5 trillion or 56.6 percent of total public debt and 30.7 percent of GDP at the end of September 2022.

The increase is due to the high deficit financing and debt refinancing, according to Treasury.