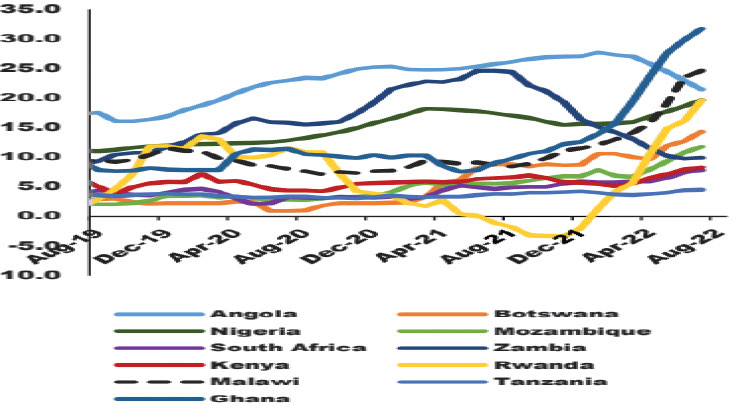

Global commodity prices drop offers relief—RBM

The Reserve Bank of Malawi (RBM) says the continued price declines observed in some key commodities such as oil on the global market could offer some relief regarding the trajectory of inflation in the short-term. In its August 2022 RBM Market Intelligence Report issued yesterday, the central bank, however, observed that inflation rate remains high at 25.5 percent as effects of the commodity price decrease slowly filter to domestic prices.Reads the report in part: “Mirroring developments in view of failing commodity prices during the month of August, economies could start experiencing easing inflation pressures.”

RBM said food and energy prices remain the major sources of rising inflation and that commodity prices are still high relative to a similar period in 2021. The central bank said it remains vigilant and will take necessary action to ensure that inflation reverts to low and stable levels.On the global front, brent crude oil prices continued to slow down and stood at $96.6 per barrel in August from $108.9 per barrel in the previous month.In tandem with the global oil price development, which was as a result of subdued demand amid improved supply following the resumption of the Libyan crude oil production, local retail fuel pump prices of petrol fell by 10.28 percent to K1 746 per litre.Diesel and paraffin pump prices were maintained at K1 920 per litre and K1 261 per litre, respectively.Ironically, Malawi’s inflation is fast rising triggered by a rise in food and non-food inflation.National Statistical Office data shows that headline inflation rate for August rose to 25.5 percent from 24.6 percent recorded in July this year.The figures further show that food inflation went up 33.4 percent, a rise from 32.5 percent the previous month while non-food inflation rose to18.2 percent in August from 17.5 percent the previous month.Speaking in an interview yesterday, economic statistician Alick Nyasulu said the continued rise in inflation is a cause for concern and called for reflection on monetary policy issues.He said: “As is often the case, this tends to force central banks all over the world to increase interest rates. “It will be interesting to see how the monetary policy will decide to increase the policy rate, which under such instances, tends to go up to tame the rising inflation.”The International Monetary Fund has asked local authorities to ensure that the monetary policy framework centres on containing direct and second-round food price inflationary pressures and as well as controlling overall inflation.

One Comment