Interbank rates down on improved liquidity

The softening of policy rate to 12 percent from 13.5 percent has improved commercial bank’s liquidity levels, resulting in a fall of interbank rates by about three percentages points, it has been learnt.

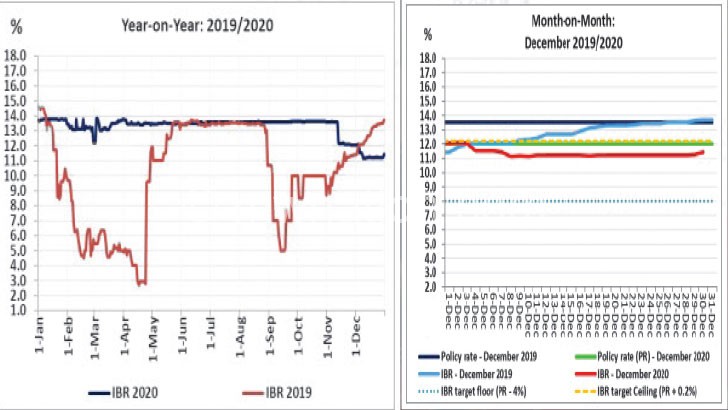

Reserve Bank of Malawi (RBM) Financial Market Development reports show that on the interbank lending market, rates started falling from November last year when the bank slashed the policy rate—the rate at which commercial bank borrow from the central bank as the lender of last resort.

RBM figures show that interbank rates or rates bank charge each other, have declined from an average 14 percent to around 11 percent.

At the same time, traded volume on the interbank market averaged K11.22 billion in the week ending December 18, a decline from K12.56 billion in the week ending December 11 2020.

Explaining the movement of interbank lending rates, Blantyre-based market analyst Cosmas Chigwe said the downward trend is largely due to the fact that most banks now have enough liquidity or cash.

He said: “Interbank rates are a direct result of market liquidity. There has been an increase in liquidity in the market between November and December by around K8 billion as a result of the central bank increasing liquidity to push down interest rates.

“This has automatically led to the decline in interbank rates for commercial banks as supply of money is exceeding demand.”

Chigwe said the development is good for the economy as interest rates are likely to continue declining and this can lead to banks reducing lending rates if the situation continues in the short to medium-term.

On his part, Cedar Capital Limited chief executive officer Armstrong Kamphoni said interbank interest rates are determined by availability of liquidity in the banking sector.

He said the downward trend in interbank rates is an obvious answer to the excess liquidity probably caused by growth in deposits and slower growth in the loan book.

The Covid-19 pandemic, which affected both the global and domestic economies, did not spare local banks, which faced serious liquidity challenges, a development that pushed the central bank to take measures to ease pressure on the banks.

Early last year, the Monetary Policy Committee (MPC) of the RBM reduced Liquidity Reserve Requirement ratio on domestic and foreign deposits at 3.75 percent and the Lombard rate at 20 basis points above the policy rate.

At its fourth meeting of 2020 in early November, the MPC reduced the policy rate by 150 basis points to the current 12 percent.

RBM governor Wilson Banda said during the fourth MPC meeting that the banking system liquidity continued to tighten in the third quarter of 2020 as evidenced by a larger decline in unborrowed excess reserves than in the previous quarter.

He said specifically, the unborrowed excess reserves dropped to an average of negative K18.6 billion in the third quarter of 2020 from negative K7.9 billion in second quarter of 2020.

Reflecting the tight liquidity conditions, the interbank market rate remained above the policy rate and stood at 13.61 percent in September 2020 from 13.59 percent in August 2020 and 13.58 percent in July 2020.