‘New tax in gaming industry to cost jobs’

The Malawi Gaming Association says operators in the industry are considering exit strategies, including job cuts due to the recently introduced 20 percent withholding tax on gambling and betting income.

In a statement, association’s interim leader Basil McLean said they have been engaging authorities on the taxation issues, but there has been no consideration on their concerns.

Said McLean: “As operators, we had shelved our closedown and exit plans because we had so much hope that the new government would revise or reverse the excise tax imposed on the industry.

“Now that the taxes are upheld and endorsed by the current budget, there is no hope for the gaming industry to survive as it definitely cannot survive the current excise tax law.”

He said operators’ excise tax is supposed to apply on every bet received from players regardless of the fact that at least 90 percent of the amount is to be given back to the players as winnings.

McLean explained that effectively, this means that government is demanding almost 100 percent of the gross gaming revenue as excise taxes from the operators, leaving them with no cash to either pay the gaming levy, salaries or corporate taxes as they will be running at a loss.

Should the gaming industry exit Malawi, he said it will lead to closure of numerous businesses and loss of about 1 000 direct and indirect jobs.

The gaming industry is regulated under the Gaming Act of 2006 and under the Act, the gaming operators are supposed to retain a maximum of 10 percent of the amount of money (bets) they receive from players as their gross gaming revenue.

The Act compels gaming operators to give a minimum of 90 percent of the bets back to the players in the form of winnings.

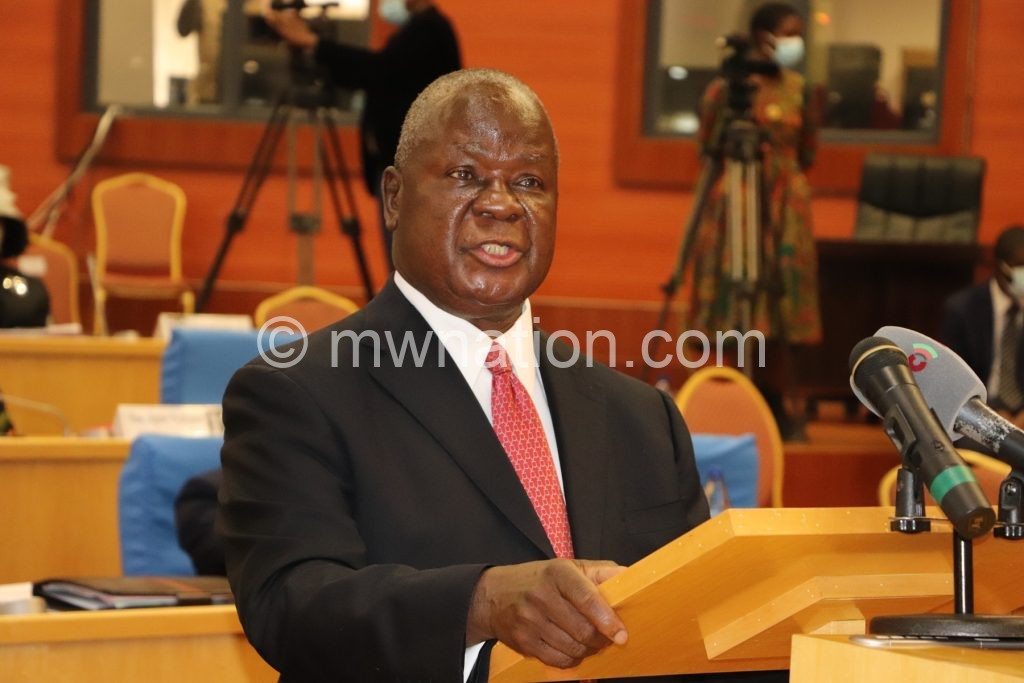

In the K2.2 trillion 2020/21 National Budget, Minister of Finance Felix Mlusu announced an imposition of 20 percent withholding tax on winnings from betting.

He said: “Government has noted increased participation in betting and gambling transactions, including lotteries.

“In order to ensure taxpayer compliance and encourage submission of income tax returns, government has introduced a 20 percent withholding tax on winnings from betting and gambling transactions including lotteries.”