Private sector credit demand rises, hits k1trn

The Reserve Bank of Malawi (RBM) says annual growth in private sector credit accelerated to 24.1 percent as at end 2022 from 18.6 percent in a corresponding period in 2021.

On a quarterly basis, the stock of private sector credit increased by K34 billion or 3.5 percent to K1 trillion in the last-quarter of 2022.

This follows another expansion of K58.9 billion or 6.4 percent in the preceding quarter.

In its fourth quarter Financial and Economic Review, RBM said that the increase in the private sector largely reflected an increase in selected loans.

Reads the review in part: “The development was driven by individual and household loans, commercial and industrial loans, foreign currency denominated loans and mortgages, which expanded by K29.1 billion, K1.5 billion, K873.8 million and K840.8 million during the fourth quarter of 2022, respectively.”

In terms of economic sectors, the report further shows that private sector credit increased significantly in the manufacturing and community, social and personal sectors to K395.2 billion and K282.6 billion respectively.

Similarly, financial services, construction, restaurants and hotels, transport, storage and communications and mining and quarry also rose to K66.6 billion, K53.2 billion, K35.8 billion, K27.8 billion and K1.2 billion, respectively.

In contrast, declines were registered in the wholesale and retail trade to K326.4 billion agriculture, forestry, fishing and hunting to K273 billion electricity, gas, water, and energy to K6.1 billion and real estates to K670.4 million, respectively.

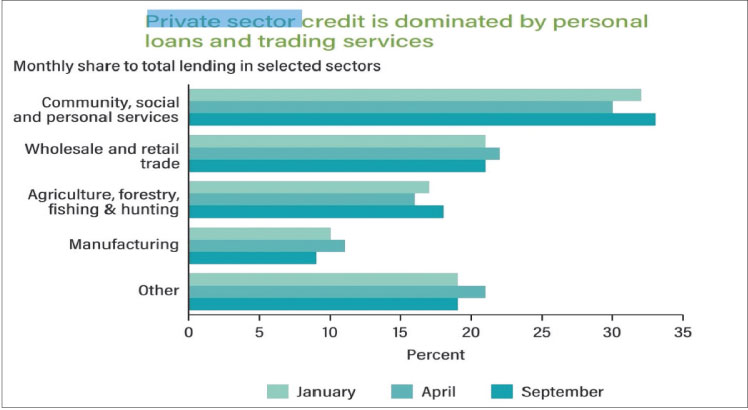

Consequently, the share of community, social and personal services sector and manufacturing sector in the outstanding stock of private sector credit increased to 35.7 percent and 13.2 percent from 33.6 percent and 9.4 percent in the third quarter of 2022, respectively.

In contrast, the share of wholesale and retail trade sector and agriculture, forestry and hunting sector declined to 17.7 percent and 14.6 percent in the review quarter from 21.6 percent and 17.9 percent in the preceding quarter, respectively.

Consumers Association of Malawi executive director John Kapito said in an interview yesterday that faced by the challenging macroeconomic environment, consumers are being forced to seek relief from commercial banks, a development he said has pushed up the demand for personal loans.

He said: “Most of the consumers are borrowing for consumption. Our key economic drivers are not performing well to boost economic activities.”

Catholic University of Malawi economics lecturer Hopkins Kawaye also observed that the current borrowing pattern is not only dangerous for households, who will eventually have to pay back, but the economy as well.

“If anything, if people are to borrow, let these loans be taken for investment that can give them returns and not purely for consumption.”