RBM sees 2023 inflation at 29.5%

The Reserve Bank of Malawi (RBM) has revised upwards its 2023 inflation rate projection to an average 29.5 percent for this year.

This is 8.6 percentage points higher than its earlier projection of an average 24.5 percent projected during the first Monetary Policy Committee (MPC) meeting and an average of 20.9 percent in 2022.

In its third MPC report issued recently, the central bank said the revision has taken into consideration persistent pressures on inflation such as supply and demand-side related shocks.

Reads the report in part: “The cancellation of the UN-backed Black Sea Port Grain Deal by Russia is another source of upside risk, as this is expected to trigger imported food inflationary pressures.

“Among the demand factors, pressures are likely to emanate from elevated public sector financing requirements as well as exchange rate developments. All these developments are driving market expectations and contributing to rising inflation.”

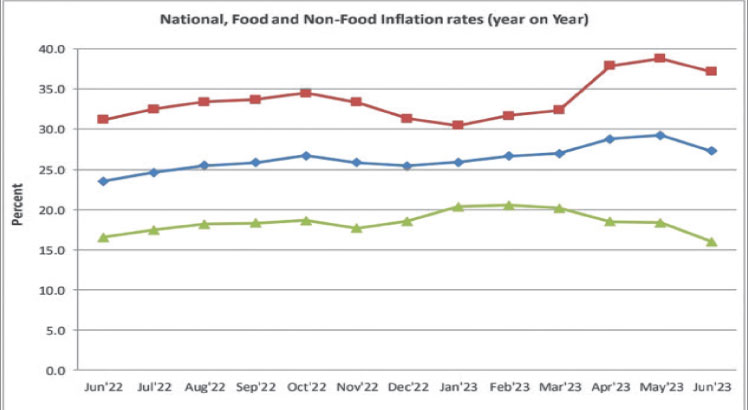

Inflation—the rate of increase in prices over a given period of time—has been on the rise for the past 12 months largely due to increase in food and non-food items.

For instance, in a space of six months, the inflation rate has moved from 23.5 percent in June 2022 to 27.3 percent as of June, according to the National Statistical Office figures.

In the second-quarter of this year alone, headline inflation accelerated to an average of 28.4 percent, from 26.5 percent in the first quarter of this year compared to 19.4 percent during the same period last year.

The outturn was driven by an acceleration in food inflation, which rose to an average of 38 percent in the second quarter of this year, from 31.7 percent during in the first quarter of this year and compared to 25.4 percent recorded during a similar period last year.

Meanwhile, non-food inflation moderated to 17.6 percent in the second quarter of this year from 20.4 percent in the first quarter of this year, but was higher than 14 percent recorded during a similar period last year.

Economic statistician Alick Nyasulu observed that a rise in inflation is expected given the current food situation in the country on top of external factors that traditionally affect inflation.

He said: “Fertiliser was not easily accessible to most farmers. This coupled with a shambolic Affordable Inputs Program also affected farmers who could access it at market prices could not get it.

“On the other hand, with Cyclone Freddy, crops were destroyed in the South, the most populous part of the country. All this will continue to put pressure on food prices and we should expect further surge in inflation unless there is a deliberate intervention by authorities to flood the market in selling points. The likelihood of bank interest rates going up is there as well,” he said.

Meanwhile, the International Monetary Fund has since projected that Malawi’s 2023 annual inflation rate will average 26 percent due to the rising commodity prices in the year.

In its recent World Economic Outlook, the global lender underscored the need for the central bank to ensure that monetary policy focuses on keeping inflation down.