Remittances jumped 55% in 2021—report

Remittances to Malawi rose by 55 percent to $217 million (about K180 billion) in 2021, according to the World Bank, a development an economist says helped to raise the welfare of many Malawians.

Remittances are monetary transfers sent from migrants to their homes through formal and informal channels

In its recent analysis for Malawi, the World Bank said remittances are also helping to finance the country’s trade deficit, which stood at $484 million (about K397.84 billion) as at September 31 2021.

On an annual basis, the Bretton Woods institution expects remittances to reach 2.4 percent of the country’s gross domestic product pegged at $10.9 billion (about K8.9 trillion), which could help cover about 10 percent of total imports or 20 percent of the trade deficit.

In an interview on Sunday, Malawi University of Business and Applied Sciences associate professor of economics Betchani Tchereni said having remittances channelled through the formal means could be key to easing the country’s foreign exchange challenges.

He said: “Remittances are a big income generation activity for many families in Malawi. Many people are able to pay school fees for their children and build houses, among others.

“We noted, for example, that in November and December, the kwacha gained some value. This could be because of the remittances among other things.”

A recent report from the United Nations Economic Commission for Africa (Uneca) found that the cost associated with sending remittances to African countries, including Malawi, is one of the highest in the world, a development that affects flow of money.

The report said, for instance, people sending $200 (about K164 000) to sub-Saharan Africa countries pay an estimated 8.9 percent or about $18 (about K15 000) of the value of the transaction.

Reads the report in part: “The cost of sending money in Africa is high, which means the continent is still far from achieving the three percent target set out in Sustainable Development Goal number 10.”

Uneca advised governments to support migrants and their families through the adoption of laws and regulations to facilitate the sending and receiving of remittances.

Economics statistician Alick Nyasulu said in an interview that remittances to Malawi hinge on Reserve Bank of Malawi (RBM) exchange rate rules, apart from the cost.

He said: “There are a lot of remittances coming in through informal channels.

“Most of the diaspora see no value in these foreign currency accounts as the rules make it difficult for most of them to access their money in the currency of their account.”

Nyasulu said apart from the cost element, the country’s tight regulatory framework makes sending money difficult.

“We are getting a lot of foreign currency, but the channels are outside the banking system. One should ask why we have a vibrant foreign exchange market and where are the funds coming from. The answer is too much regulation,” he said.

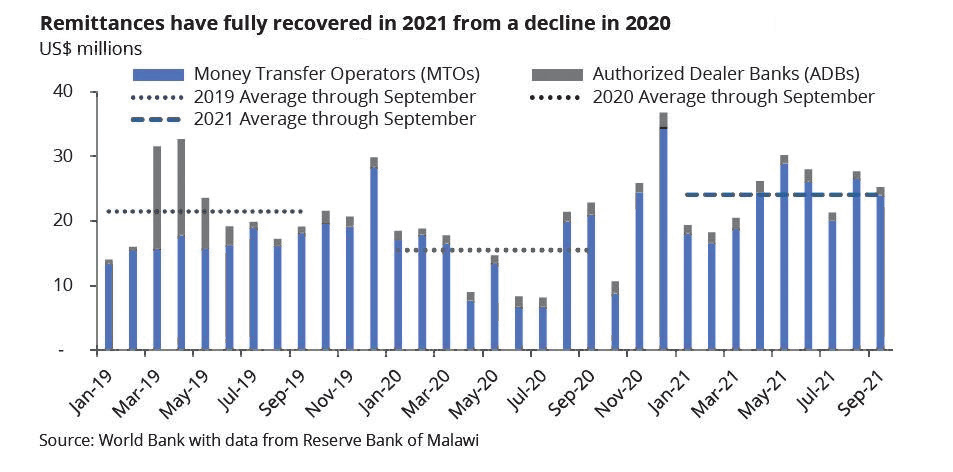

RBM figures show that in 2020, the country received $214.5 million (about K169 billion) in personal remittances, a drop from $265.7 million (about K208 billion) in 2019.

The central bank earlier attributed the drop to the economic crisis brought by the Covid-19 pandemic, which triggered a fall in wages and employment of migrant workers.

Resultantly, 80 percent of households in Malawi experienced a decline in remittances, a situation that affected the critical lifeline for the poor and vulnerable.