World Bank sees widened fiscal deficit

T

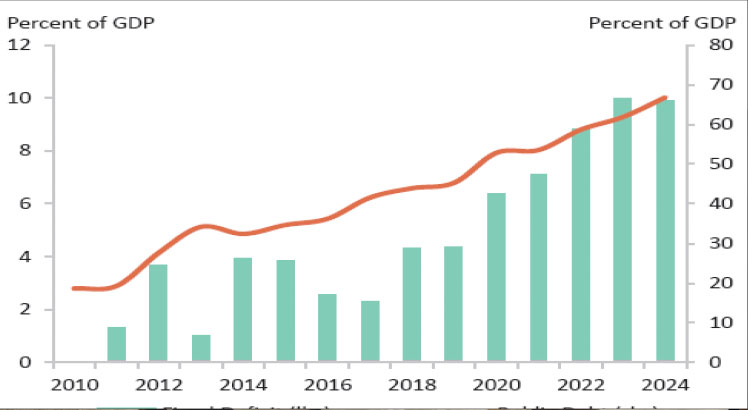

he World Bank has projected the country’s fiscal deficit at 10 percent of the gross domestic product (GDP), countering the government’s projection of fiscal deficit for this financial year.

A fiscal deficit is a shortfall in a government’s income compared with its spending.

At 10 percent of GDP, the deficit is 2.3 percentage points above the government’s 7.7 percent projection for the year under review.

In its October 202 Malawi Poverty Outlook, the multilateral development bank observed that the weak fiscal management is contributing to high fiscal deficits, resulting in increased high-cost domestic debt.

Reads the outlook in part: “Public debt, already at high and unsustainable levels is projected to increase further due to high fiscal deficits. Non-concessional external debt incurred to support foreign currency reserves is currently being restructured but remains a concern.”

The World Bank has also indicated that despite ongoing consolidation efforts, expenditure will likely further rise owing to increased recurrent spending from elevated commodity prices.

In the 2022/23 budget, overall fiscal balance is estimated at a deficit of K884 billion, which is 7.7 percent of GDP to be financed through foreign borrowing amounting to K230.07 billion and domestic borrowing amounting to K653.98 billion.

The deficit is one percentage point lower than that of the 2021/22 financial year.

Minister of Finance and Economic Affairs Sosten Gwengwe is on record as having said Treasury is implementing a strategy aimed at reducing the fiscal deficits by reducing the financing gap by a percentage point every fiscal year until the gap closes in the medium-term.

He said: “Closing the gap requires two things; firstly is to try and live within our means. This means cuts, expenditure controls and efficiency in public service delivery.

“Second is to enhance revenue mobilisation. We intend to aggressively pursue the recently launched Domestic Revenue Mobilisation Strategy.”

Budget deficits, reflected as a percentage of GDP, may decrease in times of economic prosperity, as increased tax revenue, lower unemployment rates, and increased economic growth reduce the need for government-funded programmes.

Economics Association of Malawi (Ecama) executive director Frank Chikuta, in an interview last week, warned that Treasury ought to ensure that it maintains the deficit within the targeted limit.

He said: “It would be better to see that the budget is not increasing because if the outcome is higher than the programme then this is certainly something which needs to be given attention.”

In Malawi, previous experience has shown that fiscal deficits have been financed mainly by costly domestic borrowing.

The rising domestic financing since 2018 as well as borrowing from regional development banks on non-concessional basis have since significantly increased Malawi’s public debt which stood at K6.38 trillion or 63 percent of GDP as at June 2022.

Meanwhile, total revenues and grants for the 2022/2023 fiscal year are estimated at K1.956 trillion representing 17.2 percent of GDP, while total expenditure is projected at K2.84 trillion, representing 24.9 percent of GDP.

Of the total expenditure, recurrent expenses are estimated at K2.019 trillion, and development expenditure is programmed at K820.67 billion.