Bad loans rise

Outstanding loans to the private sector obtained from commercial banks have been on the rise in the half year period ended June 30, a situation industry and consumers have linked to the high interest rate environment.

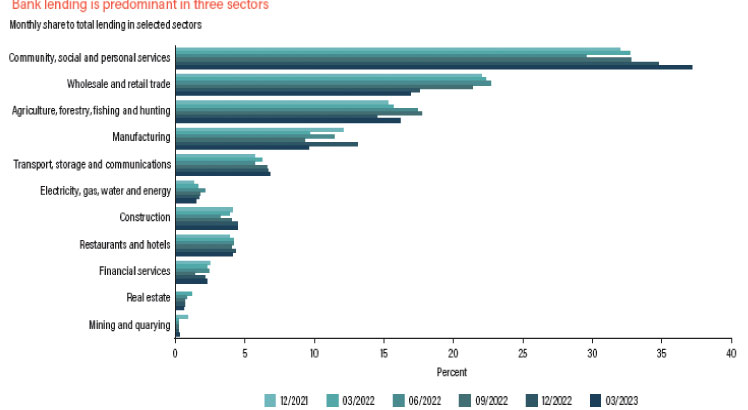

Commercial banks’ published financial results for the half year period ended June 30 2023 show that community and individual, manufacturing and agriculture sector loans are claiming the highest outstanding loans to the banking sector.

In addition, this other sectors such as wholesale and retail trade, among others, have also reported higher outstanding bank loans compared to the same period in 2022.

For instance, financial statements for the period ended June 30 2023 show that Malawi Stock Exchange (MSE)-listed Standard Bank plc community and individual loans rose by K20 billion rise to K111.61 billion from K90.41 billion in a similar period last year.

Similarly, NBS Bank plc financial statement indicates that loans extended to the community and individual sector grew to K90.97 billion from K31.60 billion in a similar period last year whereas credit extended to the manufacturing sector slightly declined to K7.86 billion from K8.40 billion.

FDH Bank plc financial statement also shows that it registered an increase of K2.18 billion in loans extended to community and individual sector in the period ended June 30 and a K1.46 billion rise in loans extended to the manufacturing sector.

In an interview on Tuesday, National Working Group on Trade and Policy chairperson Fredrick Changaya observed that development shows how much the private sector has been strained.

He said the situation is a reflection of the effects of the tight monetary policy the country is implementing.

Changaya, who is also Applecore Grain and Milling Limited managing director said: “In an economy like Malawi, the tight monetary policy hardly achieves the objective of containing inflation but instead it hurts the productive sector as evidenced from the current situation.

“On the other hand, the people they are trying to stop from borrowing already accessed loans from the banks and they are simply failing to honour their obligations due to the ring interest rates. As we speak, most businesses have now halted expansionary plans and prioritised containing pressure of doing business which is a people cost to the economy.”

Consumers Association of Malawi executive director John Kapito attributed the high debt levels to rising cost of borrowing and declining consumer demand amid rising cost of living.

He said: “The cost of borrowing has risen to levels that very few can afford to pay back. It is becoming even harder for those that borrow to buy and sell as consumer demand for goods and services has drastically gone down due to lack of disposable incomes.

“Also, individuals are finding it hard to pay any loans as the cost of living keeps rising, providing no extra resources to pay loans while we continue seeing high interest rates and charges.”

Meanwhile, Malawi Confederation of Chambers of Commerce and Industry manufacturing sector chairperson Goodwin Ngoma said the development is not a surprise given the current business environment.

He said:“Most manufacturers are affected by the forex scarcity situation. That has affected most manufacturers just like any other business in Malawi today.

“Very few companies are still producing at the optimal capacity. Business has dropped while interest rates have increased and this is what is affecting the loan repayment.”

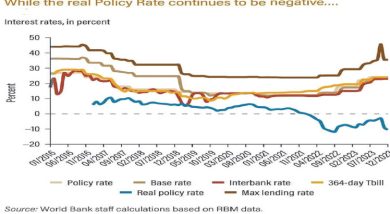

In view of rising inflation, the central bank adjusted upwards the policy rate by two percentage points to 24 percent from 22 percent, further exerting pressure on borrowers.

Effectively, banks have hiked their reference rate, an interest rate benchmark used to set other interest rates, to 22.7 percent from 21.4 percent last month.