Households struggle to generate income

Consumers Association of Malawi (Cama) and small-scale businesses say many Malawians are not generating income due to the harsh economy and “unfriendly business policies”.

The two groups said this yesterday in reaction to a World Bank report, launched on Tuesday in Lilongwe, which shows that households’ incomes remain low as transition from agriculture to higher return activities such as household businesses is proceeding slowly, thereby affecting people’s well-being.

The development, according to the Bretton Woods institution, has left the share of households with the main source of income coming from household businesses at a paltry 11 percent of the country’s population in the past decade.

Speaking in an interview yesterday, Cama executive director John Kapito said many Malawians face difficulties to access finance because most of the financial institutions demand collateral, which many lack.

“On the other hand, diversification from agriculture to other business ventures is difficult because most Malawians are facing multiple challenges, as such, the little they are getting is simply going to consumption and not investment,” he said.

Chamber for Small and Medium Businesses Association executive secretary James Chiutsi admitted that small businesses struggle to start businesses due to the long-standing issue of finance.

He said: “Many financiers in Malawi are still not willing to give long-term financing to small and medium enterprises due to perceived risks and uncertainty on the market.

“This leaves most businesses struggling to remain afloat or boost their businesses because they have nowhere to access additional or indeed startup capital for their businesses.”

In its Malawi Poverty Assessment Report titled ‘Poverty persistence in Malawi, climate shocks, low agricultural productivity and slow structural transformation’, the bank observed that the household shift towards business orientation is affected by low access to credit, markets and training skills as such fail to ably generate income.

Reads the report in part:: “Malawi households have limited opportunity to move into household businesses with many factors limiting the already slow trend of moving away from low return activities, notably agriculture into higher return activities such as household businesses.

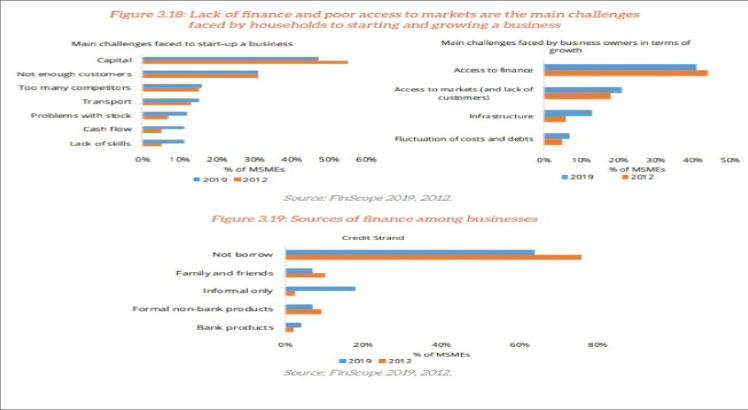

“While moving away from agriculture implies an ability to overcome three key barriers to creating and growing a non-farm business, the main difficulty faced by households when seeking to start a business is lack of initial capital.”

According to the bank, 50 percent of businesses have reported this limitation in the past decade as a result the main source of capital comes from household savings, an option that is still limited to few households.

The bank has also indicated that lack of access to markets constrains the establishment and growth of businesses and low levels of education and lack of training and skills affect also the survival of the businesses.

The World Bank has called for improvement in non-farm employment options, for example, by redoubling on-going government efforts to support the private sector to create jobs and pull labor out of agriculture.

In Malawi, capital for start-up businesses has remained a challenge where majority of businesses in the country are failing to access finance.