RBM admits foreign exchange mismatch

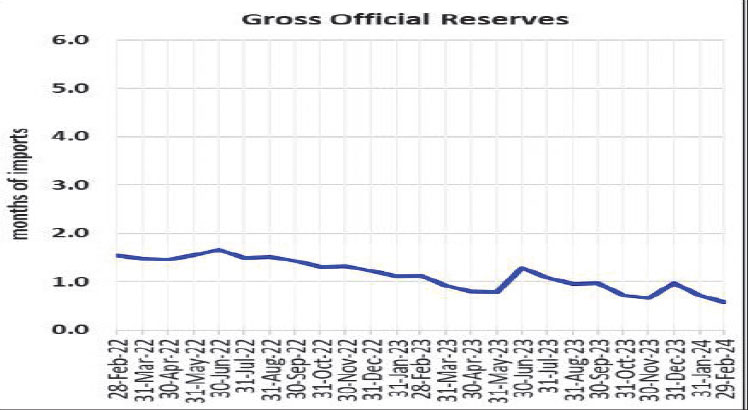

The country’s official foreign exchange reserves have continued to fluctuate since November last year when Malawi clinched the four-year International Monetary Fund (IMF) Extended Credit Facility (ECF), it has been learnt.

But the Reserve Bank of Malawi (RBM)has attributed the situation to the mismatch between supply and demand of forex despite improved donor inflows.

RBM figures show that official forex reserves have dropped to $143 million (about K243 billion) or 0.57 months of import cover at the end of February.

When compared to the same period last year, the official reserves were recorded at 1.12 months of import cover, according to RBM figures.

The figures further show that private sector reserves that comprise foreign currency denominated accounts and those held by authorised dealer banks have also declined from $401 million (about K682 billion) or 1.61 months of import cover at the beginning of March to $396 million (about K673 billion) or 1.59 months of import cover as of Tuesday.

This means that cumulatively, the country is sitting on $539 million (about K916 billion) or 2.16 months of import cover, which is way below the internationally recommended three months of import cover, regarded as the rule of thumb.

The forex reserves position contradicts earlier projections by the RBM that the reserves would have improved by last December based on inflows triggered by Malawi’s clinching of four-year Extended Credit Facility (ECF) with the International Monetary Fund (IMF).

In an interview yesterday, RBM spokesperson Mark Lungu admitted that there is continued imbalance of forex inflows and market demand despite improved donor inflows.

“The country received some foreign exchange inflows from its developing partners after going on an ECF programme and continues to receive that support even now,” he said.

Lungu said the foreign exchange is being used to facilitate importation of strategic commodities such as fuel, fertiliser and pharmaceuticals.

“While the focus is mostly on official reserves which are managed by the central bank, we have seen an improvement in foreign exchange reserves of the private sector following a number of measures taken by the central bank. That said, the country continues to face a mismatch between supply and demand of foreign exchange.”

The ECF unlocked several grants from development partners that include 70 million euro (K134 billion) from Germany, $137 million (K233 billion) from World Bank for budget support with another $57 million (K97 billion) for Catastrophe Differed Drawdown and $240 million (K408 billion) from the bank for Regional Climate Resilience Programme.

Some of these resources, including the IMF’s $35 million (K60 billion) as the first tranche for the $175 million (K297 billion) ECF programme were already disbursed.

Economic analyst Bond Mtembezeka said in an interview on Tuesday most interventions have a medium to long-term kick-in effect.

“Short-term interventions will not be sustainable and enough at this point as we have slipped beyond a short-term salvageable point,” he said, adding that there is a serious backlog of payments that need to be cleared and any flow of foreign exchange is easily wiped out.

However, in its latest bi-annual Malawi Economic Monitor, the World Bank acknowledged that the ECF programme has not helped to improve the country’s foreign reserves challenges, calling for sustainable measures such as unlocking the full potential in key priority areas of mining, tourism and agriculture.

The bank further observed that the country is yet to make significant moves towards industrialising the sectors that require significant private and public sector investments, warning that failure to make strides in exploiting these priority sectors will continue to dampen meaningful growth which is required to reduce poverty levels.

Malawi requires at least $250 million (K425 billion) every month to sustain its imports, but with the current reserves, there is a huge monthly deficit against the international standard of at least three months of reserves at any given time.

The 2024 Malawi Government Annual Economic Report prepared by the Ministry of Finance and Economic Affairs shows that in 2024, the current account balance is expected to slightly improve.

In 2023, trade balance worsened by 7.7 percent from a deficit of $2 billion (K3.4 trillion) in the previous year to $2.2 billion (K3.7 trillion) as there was increased demand of petroleum, pharmaceuticals and farm inputs with exports registered at $1.1 billion (K1.8 trillion) against a $3.3 billion imports.