Why fiscal, monetary policies could falter

Treasury has found itself, yet again, in an expansionary policy path, having increased expenditure projection in the 2024/25 financial year by 37 percent.

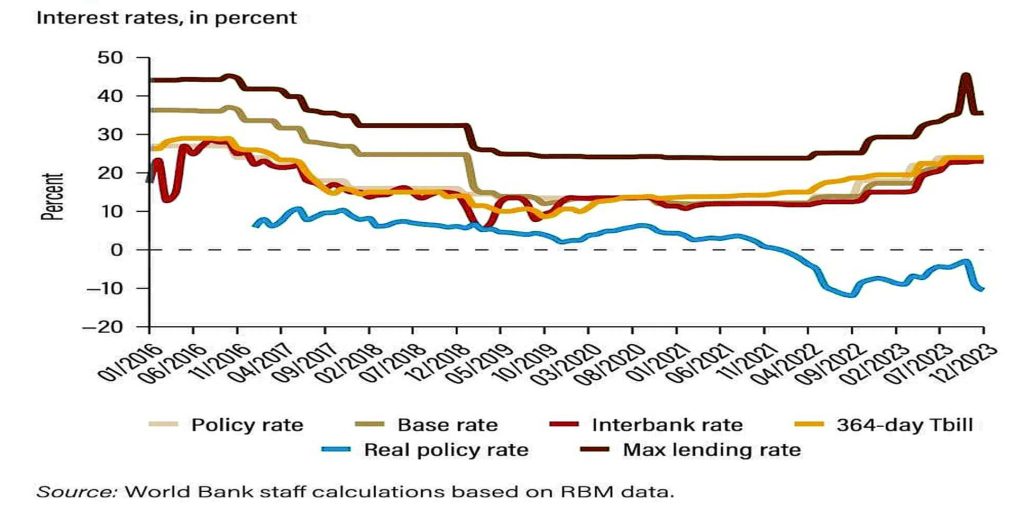

However, the increase is happening at a time the Reserve Bank of Malawi (RBM) adjusted the policy rate to 26 percent in February, which means pursuing a tight monetary policy stance.

The divergence, according to analysts, presents a risk that neither policy will meet its objective.

In an interview on Tuesday, Scotland-based Malawian economist Velli Nyirongo observed that maintaining price stability and growing the economy could be a far-fetched dream.

He said: “Ideally, these two policies should operate in tandem. The government is on an expansionary policy path, increasing budget spending and reducing some taxes while the central bank has raised interest rates to decrease the money supply in circulation.

“This divergence presents a risk that neither policy will meet its objectives. It is crucial for the Treasury and the Reserve Bank of Malawi to enhance its synergy to avoid the potential risk of undermining each other’s objectives.”

In the 2024/25 financial year, Treasury is expected to implement a K5.9 trillion budget, a 37 percent increase from the previous financial year.

At the same time, the monetary policy rate increasing from 24 percent to 26 percent.

Ironically, domestic borrowing, pegged at K1.28 trillion, constitutes 94.5 percent of the total borrowing and represents a four percent increase from the previous year.

The projected domestic borrowing is also 21.5 percent of total government expenditure and eight percent of the gross domestic product.

This, according to economist Gilbert Kachamba, can have implications on effectiveness of fiscal stimulus, increased borrowing costs and inflationary pressures.

He said: “There are mixed messages coming from these monetary and fiscal policies and this has the potential to make it harder for both policies to achieve their goals effectively.

“There must be proper coordination between fiscal and monetary policy authorities to avoid conflicting effects on the economy.”

Economists argue that rising cost of borrowing hampers investments in the real economy and also hinder economic growth.

Speaking in an interview, economist Bond Mtembezeka observed that if lagged effects of devaluation and policy rate increases have not fully manifested, there would be further pressure on the budget as prices continue to climb and the budget will no longer be the same K5.9 trillion.

“The policies are definitely not speaking to each other. We presently have what is called fiscal dominance where fiscal Policy inadvertently dominates and dictates monetary policy and monetary policy becomes less and less effective,” he said.

Earlier, RBM said the hike in the policy rate to 26 percent in the current circumstances will ensure durable recovery of the economy.