Dealers tip govt on forex supply

Financial Market Dealers Association (Fimda) has urged fiscal authorities to stop acquiring more non-productive foreign loans, control appetite for programmes that consume more forex and ensure that all forex generated is accounted for.

Fimda president Maclewen Sikwese’s comments come against the backdrop of huge demand for imports against limited exports, which continues to strain foreign exchange supply.

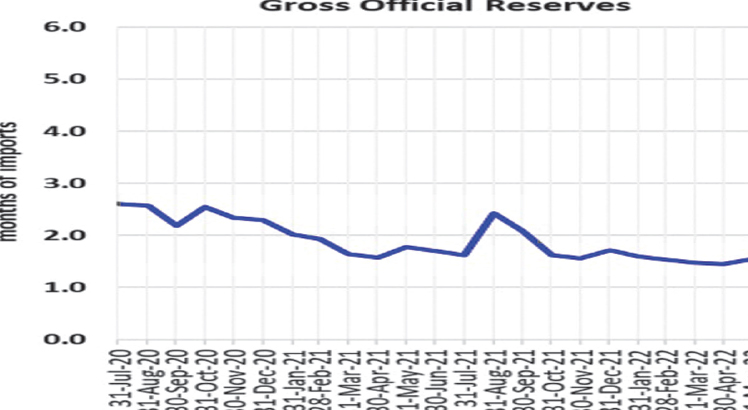

Reserve Bank of Malawi (RBM) Financial Markets Development Report shows that gross official reserves, which are under the direct control of the central bank, have dropped to $372.99 million, an equivalent of 1.49 months of import cover in July this year from $404.18 million or 1.62 months of import cover during the same period last year.

In January this year, foreign exchange reserves were at $399.98 million or 1.6 months of import cover.

In an e-mail response yesterday, Sikwese said the 25 percent devaluation of the kwacha effected on May 27 this year addressed the demand side of the foreign exchange problem.

He said: “The bigger issue is how to manage the supply side of the problem, which is more structural; hence, it is going to take a while for the foreign exchange situation to be addressed.

“In the medium to long-term, structural issues around exports and import substitution would be key to address the forex challenges.”

Sikwese said if the available foreign exchange has been used to fund current consumption needs with no significant changes in foreign obligations, it would be counterproductive with regards to the country’s prospects of getting out of the current foreign exchange situation.

When RBM devalued the currency, it argued that the move was necessary to align the foreign exchange supply to the macroeconomic fundamentals as well as ensure supply in the formal market.

As part of interventions to ensure supply of foreign exchange, fiscal authorities formalised the repatriation of export proceeds and operation of foreign currency-denominated accounts scheme in June to increase circulation of foreign currency and ensure timely repatriation of all export proceeds to Malawi.

Malawi University of Business and Applied Sciences associate professor of economics Betchani Tchereni said the depletion of the foreign exchange reserves could also be linked to inflationary pressures.

“In the short-term, we need the monetary authorities to work swiftly to normalise the situation,” he said.

RBM Governor Wilson Banda is quoted as having said that in the long-term, export growth is important, adding that the current measures, including the 30 percent mandatory sale of foreign exchange from exports, is a short-term measure.

“In an ideal environment, exporters should have the liberty to hold on to 100 percent of their export proceeds, but we think that is the best that can happen to the economy,” he said.

Meanwhile, since the devaluation of the kwacha, the unit has continued to lose value though moderately from K1 030 when the devaluation was effected to around K1 036 to a dollar as of yesterday.