Industrial rebate scheme bites

Treasury has revised upwards the value addition threshold under the Industrial Rebate Scheme (IRS) from 20 percent to 35 percent.

The review comes 34 years since the threshold was last revised in 1986.

Treasury spokesperson Williams Banda said the revision has been done to align Malawi with her counterparts in the Common Market for Eastern and Southern Africa [Comesa] region and “to make the [country’s] products competitive in Comesa”.

The general pattern of the IRS is that various types of industries are approved for rebate, and specified materials for use in a particular industry may be imported, or delivered from an excise factory, at reduced (i.e. rebated) rates of duty.

Once an industry has been approved, manufacturers may apply for registration in that industry in order to take advantage of the rebates on the materials.

In its present form the IRS promotes the local industry by exempting manufacturers from paying customs duties and excises on selected materials that they import to be used in the production of eligible goods.

However, in a published statement Malawi Revenue Authority (MRA)—the agency that manages the IRS with involvement of the Ministry of Finance—said the revision follows a Malawi Government notice number 23 of June 12 2020 which amended the principal order paragraph 5 in part 1 of the Eighth Schedule.

The revision has irked National Working Group on Trade and Policy. It’s chairperson Frederick Changaya observed Thursday that the impact of such a tariff regime will be heavy on local industry, particularly in the short to medium-term.

This, he said, would be the case as it limits the potential room for value addition as value from conversion of primary to intermediate goods would have been forgone.

He said: “Much of our industries are finishing firms. They convert intermediate into final product. Therefore, raising the threshold for value addition will reduce competitiveness for local companies as many may fail the test. This in the short term would favour regional bouncers such as South Africa and Kenya.”

As such, he said, the country should expect the terms of trade to worsen, a development which could also potentially affect the Tonse Alliance desire to create a million jobs.

“We will see an influx of imported finished goods in Malawi. We already have poor and expensive energy and expensive cost of capital.

“Now you increase the threshold to 35 percent? There is need for critical interrogation of some of these pacts to benefit the people of Malawi,” worried Changaya.

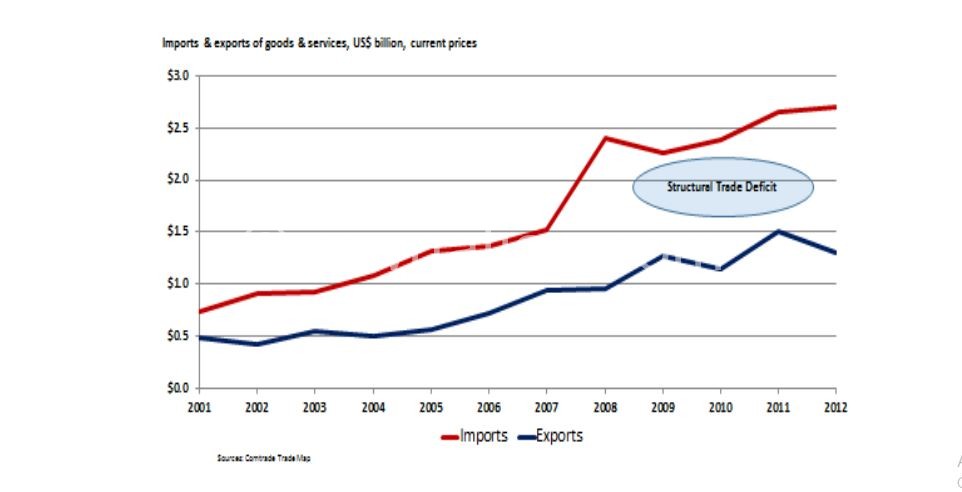

Over the past decade, Ministry of Trade figures indicate that Malawi’s total trade (imports and exports) increased by mere 11 percent from $3.2 million in 2009 to $3.6 million in 2018.

Total exports fell by 26 percent from $1.2 million in 2009 to $ 880 million in 2018, while imports increased by 34 percent from $2 million to $ 2.7 million.

However, Malawi’s total imports from Africa in 2018 were $808 million, constituting 37 percent of total imports with South Africa as the main source of imports for Malawi at $500 million or 62 percent of total imports from Africa.

Speaking recently, Malawi Confederation of Chambers of Commerce and Industry (MCCCI) director of business environment and policy advocacy Madalitso Mandiwa Kazembe observed that there are still some supply-side constraints which are yet to be addressed but are affecting the country’s competitiveness including taxation issues, smuggling, infrastructure, energy and telecommunications.