Standard Bank outlines 2022 risks

Standard Bank Malawi plc chief executive officer Phillip Madinga says the bank is positiveon growth despite some global economic threats, including the Russia-Ukraine crisis that is threatening the stability of global economies.

He was speaking in an interview on Tuesday after hosting a Standard Bank plc Investor Briefing at Bingu International Convention Centre in Lilongwe which sought to explain the 2021 financial year results which have seen the bank posting a net profit of K24.8 billion, afour percent increase from the previous year.

Madinga said: “We are optimistic about the future for a couple of reasons as much as we also want to manage the risks. We are very clear in our vision about what we want to achieve based on the four pillars in Malawi 2063, agriculture commercialisation, urbanisation and industrialisation.

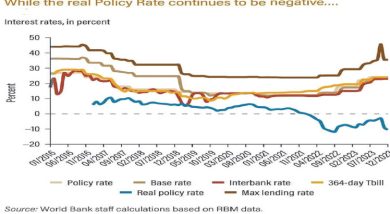

“We have seen inflation pressures going up that may put pressure on interest rates. We also see global effects like the crisis in Ukraine, which has potential ramifications on businesses and rising oil prices that may come with imported inflation.”

He singled out the Interest Capping Bill, currently being developed, as a serious threat which may affect banking business in the country going forward.

Standard Bank plc acting chief financial and value management officer John Mhone said based on their analysis, if the Bill is passed, it will have enormous effects on business.

He said: “When we plug in the numbers, we have realised that should we pay very high dividend ratios, then our capital adequacies will not be within the minimum requirement.”

In a written response, financial market analyst Emmanuel Chokani, who is also Bridgepath Capital Limited chief executive officer, said based on the 2021 outcome, the bank has sustained a positive trajectory in a difficult environment, scoring highly on growth on net interest, non-interest income, loan book and digital platforms, among others.

Compared to 2020, Standard Bank’s operating costs were 20 percent up as a result of the increase in prices of goods and services as well as the groups’ investments in information technology in line with the bank’s digital transformation strategy.

Notwithstanding the negative effects of the pandemic and the unfavourable macroeconomic environment, the bank’s earnings per share grew to K106 in 2021 from K101 in 2020.