Firms in K27bn pension arrears, says RBM

The Reserve Bank of Malawi (RBM) says companies and organisations are yet to remit K27 billion in pension arrears to pension fund managers, a development that puts in jeopardy employees’ contributions.

Figures provided by RBM principal examiner for pension regulation Peter Kambalame show that the arrears have jumped from K16 billion in September last year. In 2018, the pension arrears stood at K13 billion.

He said in Mzuzu on Thursday during a client engagement seminar organised by Nico Pensions Limited that many companies are not remitting their employees’ pension funds deductions to pension fund managers, which negatively affects accumulation of retirement savings for pension members.

Kambalame said companies or organisations that are not remitting pension funds are in a way “stealing from employees” because they deduct the money, but do not remit to pension fund managers.

He said: “We expected these employers to remit K27 billion, but they have not remitted. What it means is that when employees retire or leave employment, they cannot access the pension because their employers are keeping their money.”

Kambalame said RBM and Ministry of Labour are engaging the companies and organisations to ensure compliance with the Pension Act 2010 although most of them are attributing it to financial hardships.

“With Covid-19, most of them are saying that they have not been trading; hence, not remitting. But we also know that there are some employers that have money, but don’t want to remit,” he said.

Kambalame said RBM and other stakeholders have since proposed stiffer penalties for employers that are not remitting pension contributions.

In an interview, Nico Pensions Limited general manager Gerald Chima said there is a reduction in compliance rate, with many companies not remitting pension funds deductions while others are delaying in remitting.

“As Nico Pensions Limited, we are experiencing a huge problem with a lot of defaulters,” he said.

Chima said about 20 percent of employers have fallen back in pension funds remittances, adding that RBM needs to do more to encourage compliance.

Speaking in Mangochi recently, RBM life insurance and pension fund chief examiner Kaluso Chihana said early withdrawals of pension have increased, a situation that threatens financial security in retirement.

He said between January 2020 to September 2020, there have been 17 094 withdrawals due to, among others, the impact of the Covid-19 pandemic.

Since 2011, however, there have been 90 835 withdrawals to date.

“Covid-19 pandemic is a challenge we never envisaged, but we have to find a way of dealing with this as it has affected employers’ incomes and contributions,” he said.

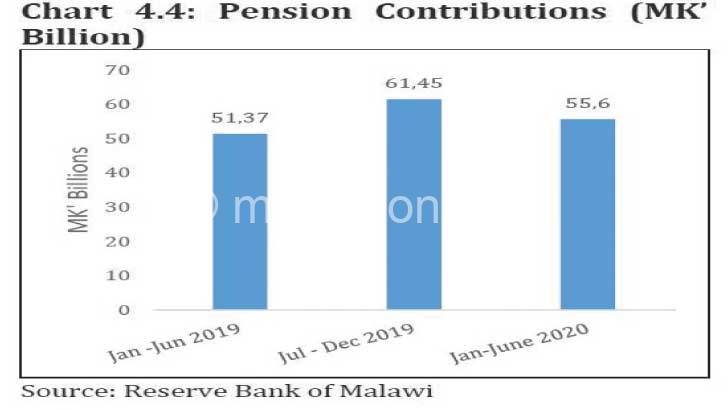

RBM figures show that as at September 2020, pension assets stood at K1.02 trillion, representing 14.7 percent of the country’s nominal gross domestic product estimated at K8.1 trillion.

The Pension Act 2010 makes pension funds remittance mandatory and under it, employers are mandated to enroll their employees on a pension scheme.

Under the law, employees contribute a minimum rate of five percent while employers are mandated to remit 10 percent of the employees’ monthly gross salary which aggregates to 15 percent monthly.