Treasury justifies borrowing from banks, non-banks

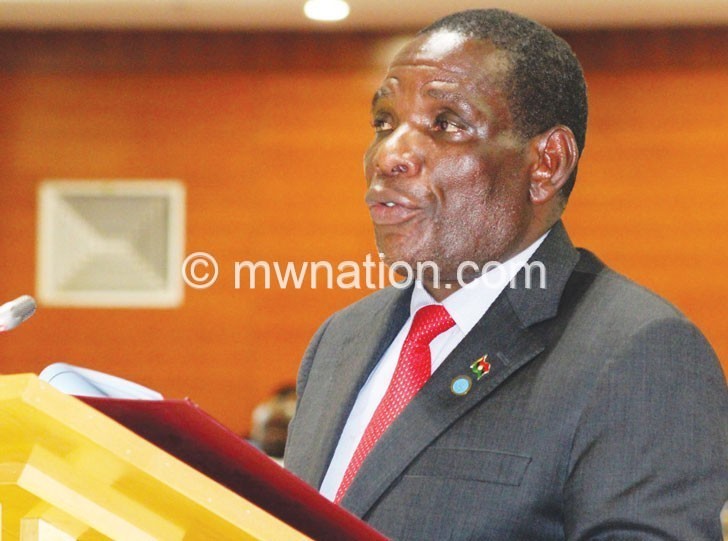

Minister of Finance, Economic Planning and Development Joseph Mwanamvekha has justified the recent move to reduce heavy borrowing from the Reserve Bank of Malawi (RBM) and instead opt for commercial banks and non-bank institutions.

In an interview in Lilongwe on Tuesday on the sidelines of a press briefing on the release of the $70 million (about K54 billion) risk management development financing by the World Bank, the minister said borrowing from banks in now cheaper for government than from RBM.

Mwanamvekha also defended such a policy shift, saying borrowing from RBM proved to be more inflationary as it involves the printing of money.

He said: “We want to be prudent by avoiding the printing of more money which pushes inflation and other macroeconomic indicators.”

The minister’s sentiments come barely a week after the World Bank, in its latest biannual Malawi Economic Monitor (MEM), revealed that for the past 18 months, Treasury is borrowing more from banks and other non-bank institutions such as insurance funds, pension funds and discount houses.

The MEM showed that government net credit from banks has more than doubled from K200 million to K403 million in the first three quarters of the 2018/19 fiscal year, which expired on June 30 2019.

The World Bank report further indicated that net borrowing from non-bank sector also increased by 62 percent over the same period from K418 million to K676 million.

According to the Bretton Woods institution, total government domestic borrowing increased by 44 percent over the past year, but largely from banks.

On his part, Secretary to the Treasury Cliff Chiunda in an interview said by resorting to borrowing more from banks and other non-bank institutions, Treasury is also complying with the recent requirement stipulated in the RBM Act which puts a cap on borrowing.

With the RBM Act in place, the central bank’s advances to Malawi Government are limited to 10 percent of total budget revenue, an attempt to address central government’s insatiable appetite for borrowing.

Many countries worldwide now use such pieces of legislation, commonly known as fiscal rules to impose ceilings within which the Treasury can maneuver with its domestic borrowing from central banks.

World Bank country economist Priscilla Kandoole said last week that while it was a good move for government to shift its focus from RBM as one key sources of domestic financing, she argued that resorting to borrowing from non-banks could also be inflationary through crowding out of the private sector. According to MEM, government borrowing from RBM declined by 57.3 percent from K353.2 billion in April 2018 to K150.8 billion in April 2019, in line with the International Monetary Fund (IMF) three-year Extended Credit Facility (ECF) programme.