Industry cautious on new pension act

Players in the pensions industry have expressed fear that the new Pension Act, which came into force on March 1 this year, could hinder investments in the country and exert pressure on the companies.

The new law replaced the old Pension Act of 2010, and has, among others, reduced employees’ wait period for proceeds from six to three months and allows one to claim 50 percent of total contributions with five years to retirement age.

The act will also see retirees getting 50 percent of their contributions, including interest

upon retirement, a revision from 40 percent in the Pension Act of 2010.

But speaking in an interview in Blantyre on Thursday after a closed-door meeting with Reserve Bank of Malawi (RBM) officials led by Governor Wilson Banda, Life Insurance and Pensions Association president Stain Singo said there is need for clear modalities to ensure the sector remains vibrant.

He said: “The wait period for one to access their benefits after employment has been reduced, but looking at the number of people who want to access their 50 percent is about K60 billion.

“This means that as an industry, we need to ensure that all our investments are in a liquid form to be able to pay.”

Singo said this is not an easy task as the life insurance and pensions industry is contributing K1.7 trillion in assets that are in investment.

“Obviously, the access by members of the said amount will affect resources available for long- term investments,” he said.

RBM executive director for regulation Patrick Mhango, while admitting that there could be pressures on pension providers in view of the new law, said the market should be ready by now.

He said: “The issue of the pension law is an important development in the functioning of the pensions industry in that pension providers do hold a lot of assets mostly in long term assets.

“Looking at the changes in the law, this has got implications in terms of how much of the assets need to be in form of liquid assets which can be easily paid out.”

But Mhango said from the discussion, they believe that the market should be ready because the new Act was passed last year and the market should be able to make adjustments.

Over the years, employees have been lobbying for changes in the Pension Act to enable them access a bigger share of the pension, which is the sum of money that is added during an employee’s employment years and from which payments are drawn to support the person’s retirement from work.

During two years of consultations, employees pushed for an increase in the lump sum access from 40 percent to 70 percent and to allow access before retirement.

Meanwhile, in its recently published Financial Stability Report, RBM has indicated that pension contribution arrears stood at K28 billion.

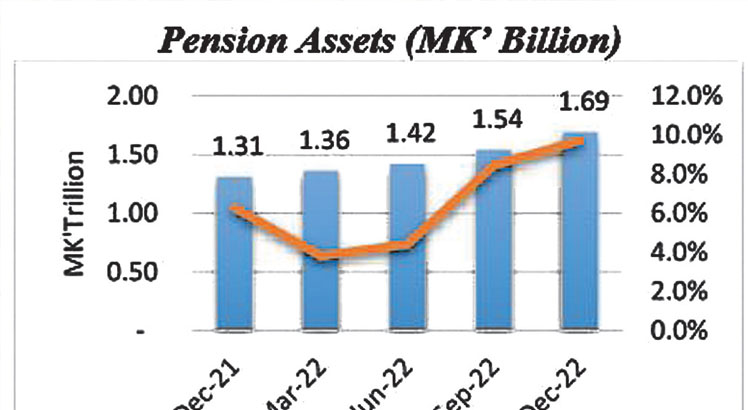

The report indicates that the pension sector was stable in the final half of the year 2022, recording overall strong growth in assets and positive annual investment returns.

But it said the pension arrears remained high at K28 billion and is a major concern in the sector.

Reads the report in part: “Additionally, exposure to inherent risks such as market, credit and inflation risks; persisted during the period under review.

RBM figures show that total pension assets accumulated to K1.7 trillion at the end of December 2022 from K1.4 trillion in June 2022