Investors shift to long-term T-bills

Money market analysts say the stable macro-economic environment has pushed investors to shift their focus to the 364 days tenor treasury bills (T-bills), which has continued to attract more subscription from investors.

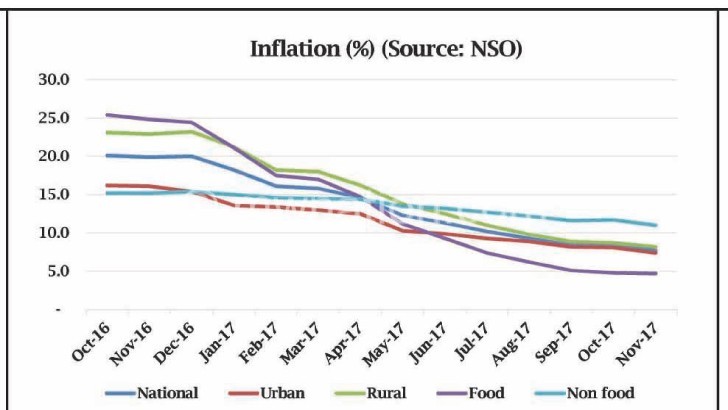

According to the analysts, in a declining interest and inflation rate environment as is the case now, investors see it best to invest in long-term fixed income instruments.

Reserve Bank of Malawi (RBM) results of the T-bills auction held last week show that the K565.42 million raised was through subscriptions made from the 364 days tenor.

In an interview, Blantyre-based money market analyst Cosmas Chigwe said that normally, the reason people have previously opted for shorter tenors is that they feel interest rates will start to rise soon but the recent economic outlook has proved otherwise.

He said: “What is happening now is that the market did not expect inflation to keep going down but it has happened.

“As such, investors are feeling that perhaps this will continue in the medium to long-term. Going forward more investors will start to prefer longer dated instruments such as the 364 day paper.”

Chigwe was, however, quick to point out that other long-term instruments, notably the five-year treasury note, which government issued recently, is a bit of a stretch considering the forthcoming election.

He said: “Unlike the rest, this note spans five years, which means more than three years after a possible regime change in 2019 which could mean radical policy shifts as we have seen in the past in this country.”

In an earlier interview, African Alliance Securities Limited chief executive officer Armstrong Kamphoni advised that going long-term is better, saying should the economy remain stable, it is good that the country moves in this direction.

Data from RBM show that the 91-day tenor is averaging 14 percent, 15 percent for the 182-day tenor and 16 percent for the 364-day tenor.

Analysts argue that interest rate on T-bills follow the decline in commercial bank interest rates.

In December last year, the central bank slashed the policy rate—the rate at which commercial banks borrow from the central bank as the lender of last resort—by two percentage points to 16 percent from 18 percent, a decision made through Monetary Policy Committee (MPC) in view of the disinflation process and the outlook for inflation.

In view of this, commercial banks slashed their base lending rates at between 23 percent and 25 percent.

Analysts argue that a decline in T-bills is positive saying may lead to a further fall in commercial bank rates.

Monetary policy authorities see inflation in the single digit going forward.

Currently, inflation rate is at 7.7 percent. n