New strategy eyes jump in financial inclusion

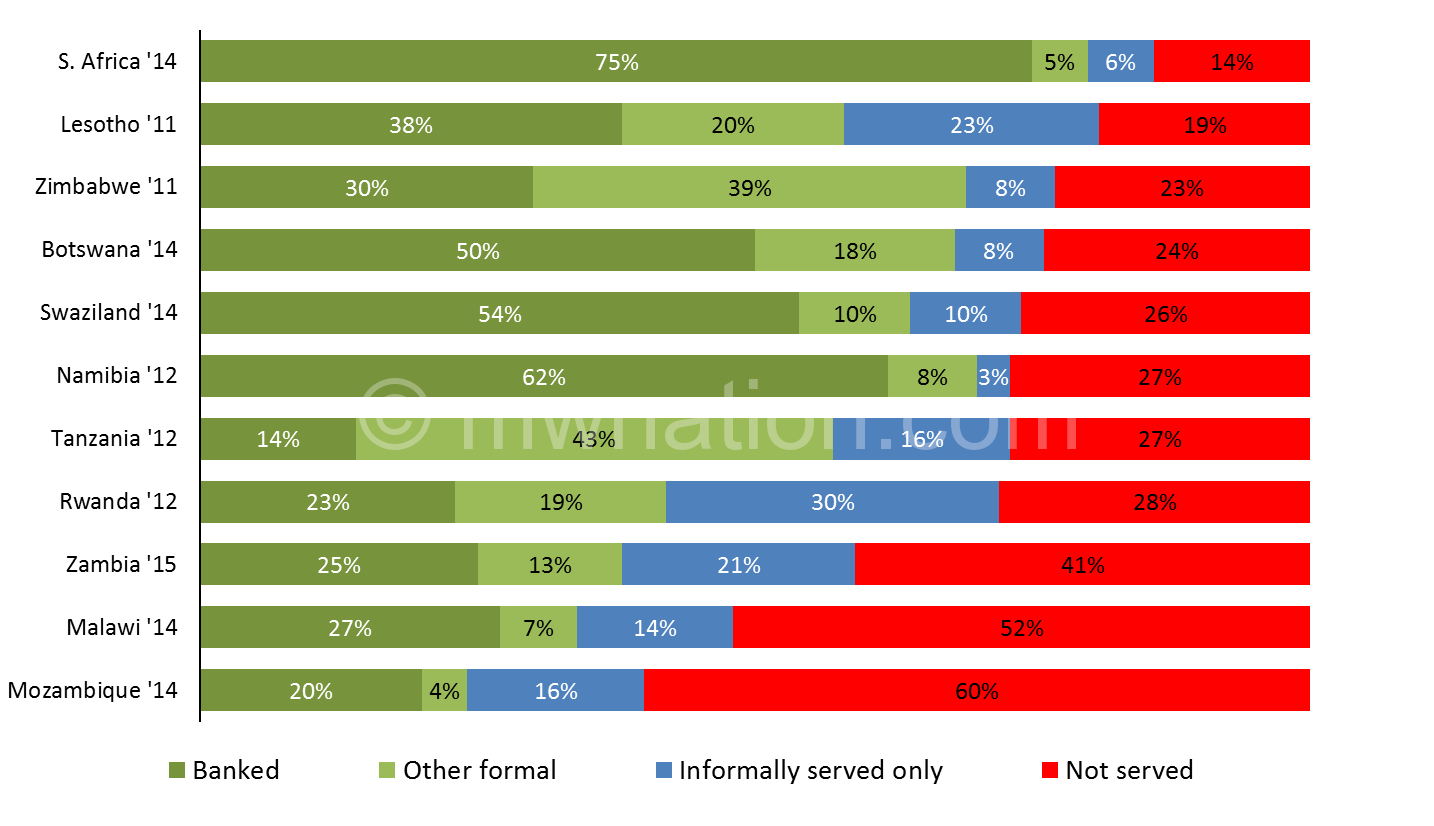

Ministry of Finance, Economic Planning and Development targets to increase the delivery of financial services at affordable costs to low-income segments of the society from 34 percent to 55 percent by 2020.

This ambitious plan is outlined in the latest National Strategy for Financial Inclusion (NSFI) 2016-2020, produced by the ministry.

Among other things, the strategy seeks to increase formal access to insurance products by five percent penetration, increase access to formal loans from 270 000 Malawians to 400 000 with at least 50 percent of the increase being productive credit to micro, small and medium enterprises and small-scale farmers as well as reduce the average cost of using a bank account from 17 percent of monthly income to five percent.

Access to finance remains one of the major obstacles to doing business in Malawi, according to Malawi Confederation of Chambers of Commerce and Industry (MCCCI).

Commercial banks remain the largest providers of financial services, accounting for more than 50 percent of the total financial assets, 92 percent of total credit and 89 percent of total deposits.

In the strategy, Minister of Finance, Economic Planning and Development Goodall Gondwe said government and all stakeholders have continually supported activities aimed at increasing access to financial services by the marginalised and underserved segments of the society.

He said: “Among other things, organisations have supported access to digital financial services, support to village savings and loans associations, increased access to affordable credit, access to offsite [agency] banking services and expansion of financial services delivery platforms.”

The Finscope Malawi 2014 survey showed that more than half of Malawian adults or about 52 percent, are without access to any type of formal or informal financial services.

During the launch of the strategy in Lilongwe last week, the World Bank Malawi decried that despite Malawi having new initiatives such as village and mobile banking and other similar innovations with outreach to small-scale enterprises and people living in rural areas, financial inclusion remains a challenge.

The bank’s senior private sector development specialist Ephraim Chilima said this development limits the ability of Malawians to manage their financial lives, the capacity to mitigate against risks and accumulate assets and invest in productive activities.

“Interest rates in Malawi are high and commercial banks also offer only a narrow range of financial inclusion,” he said, adding that the country lacks long-term financing schemes.

Reserve Bank of Malawi (RBM) Governor Dalitso Kabambe said the central bank is doing all it can to ensure that more Malawians access financial services and are investing in profitable ventures.

Catholic University of Malawi head of economics department Gilbert Kachamba said financial inclusion can be attainable if government puts in place policies to empower Malawians economically.