Savings rate on deposits declines

Commercial banks’ savings rate on deposits is fast declining currently at 3.67 percent, a situation analysts say is undesirable as it cannot attract more deposits, thereby affecting consumers’ ability to save.

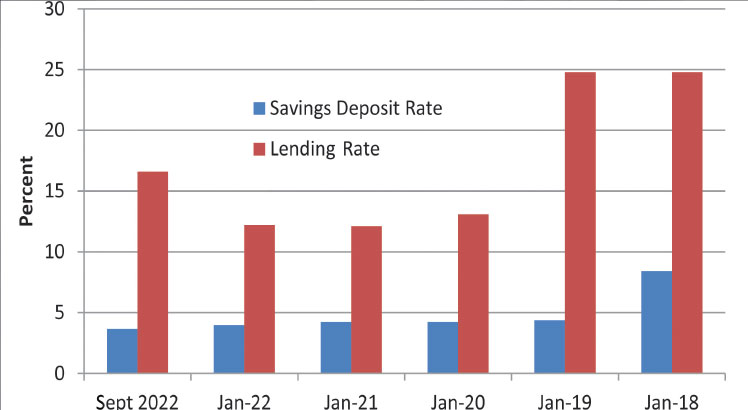

Reserve Bank of Malawi (RBM) data shows that the deposit rate at 3.67 percent is a drop from 4.36 percent recorded last year. The data further shows that the savings deposit rate was at 8.39 percent between 2018 and 2019.

At 3.67 percent, the rate also compares unfavourably to the lending rate, which is now at 17.3 percent, creating a 13.63 percent between the savings and lenders rate.

The savings deposit rate is also way below inflation, which is currently at 26.7 percent, leading to a negative real return on investment for investors, according to the money market analysts.

The analysts say this is scenario disincentive to those who save their money within the financial system, specifically banks, to earn interest.

Speaking in an interview, market and investment analyst Cosmas Chigwe said banks interest rates structure is a product of risks associated with loans, but added that there is need for competition and alternative avenues for investments.

He said: “Ideally, banks should offer different rates, but in Malawi there seems to be some level of collusion among banks, which is clearly seen by how they set their rates.

“At the moment, the sure way to this could be mutual funds whose rates are fair compared to commercial bank rates.”

Chigwe said in an environment where depositors’ rates are declining, there is need to look at alternatives which offer higher investment returns.

He said the central bank has a critical role to create a robust financial system where people have numerous saving options because with many options, there is bound to be competitive rates on the market.

Another market analyst Bond Mtembezeka said the savings rate is declining because banks understand that people open savings accounts not to actually save, but for transactions.

He urged depositors to look into alternative investment avenues with higher returns.

Said Mtembezeka: “The rule of thumb is to invest in instruments whose real return is positive.

“A real return is basically the difference between the nominal return and inflation. So, before investing or saving always take inflation into account.”

Economist Emmanuel Banda said in a separate interview on Tuesday that when deposit rates are declining, real estate and bonds are ideal investment avenues.

He said: “Within the money market, investors may opt to invest in bonds, especially corporate bonds as these carry a higher yield. Investors can opt to move out of the money market and invest in real estate,” he said.

Meanwhile, consumers Association of Malawi executive director John Kapito has bemoaned the declining earnings on deposits, saying it sends a bad signal to consumers.

He said: “Already most consumers and industries are no longer earning money and producing goods.

“Some industries have now closed while others are operating below capacity and consumers on the other hand only have little to buy basics.”

Kapito said low rates on savings push consumers to save less with the banks.

Over the years, despite the financial reforms such as interest rate liberalisation, savings rates have continued to decline at five percent of gross domestic product in 1990, negative three percent in 1993, 10 percent in 1994, negative four percent in 1996 and negative two percent in 1999, RBM figures show.