Bank’s credit demand soars—report

The banking sector’s demand for loans and credit lines has recorded an increase on account of cash-flow constraints arising from the negative impact of Covid-19 pandemic, data from the Reserve Bank of Malawi (RBM) show.

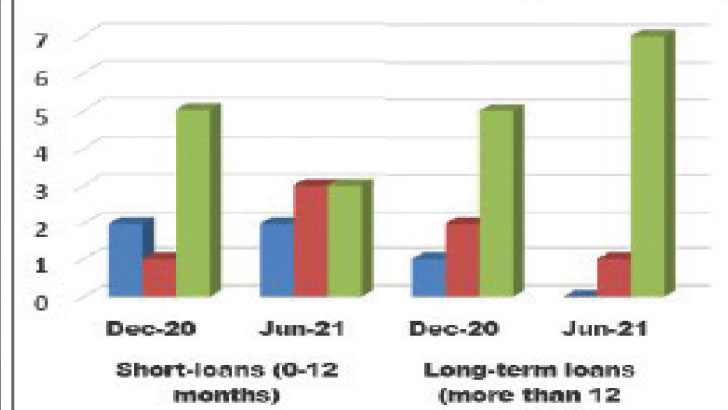

According to the RBM’s Bank Lending Survey (BLS), covering a six-month period from January to June 2021 in eight commercial banks, banks perceived an increase in demand for long-term loans which is in contrast to the previous survey findings where demand for loans was evenly distributed between short and long-term tenures.

With regard to demand for loans, however, BLS found that six-out-of-eight banks perceived increase in demand for loans, unchanged from the December 2020 survey results.

Said the report: “Banks’ perceptions corroborate quantitative data as commercial bank total credit to the private sector and statutory bodies increased by K77.4 billion to K779.8 billion between January and June 2021, compared to an increase of K74.3 billion recorded in the last six months of 2020.”

In terms of the household sector, the BLS found that five out of eight banks reported an increase in the demand for loans during the survey period while for the SMEs sector, four out of eight banks perceived an increase in demand for loans compared to seven banks in the previous survey findings.

According to the report, the perceived increase in demand for loans by SMEs was mainly attributed to trade financing and replenishment of working capital eroded due to subdued economic activity amid persisting Covid-19 pandemic.

On the other hand, continued cash-flow constraints arising from the negative impact of Covid-19 pandemic, deliberate strategy by the banks to grow the retail book, rising consumer prices and personal investments explained the perceived increase in demand for loans by the households.

Meanwhile, during the period under review, banks perceived an increase in non-performing loans (NPLs) across all the sectors.

This was in contrast to the preceding survey results which showed that banks perceived an increase in NPLs only in the households and SMEs sectors whereas NPLs in the large enterprises sector were perceived to have generally remained unchanged.

According to the report, four out of eight banks perceived NPLs in the household sector to have increased between January and June 2021, six out of eight banks perceived an increase in NPLs in the SMEs sector and four banks indicated that NPLs in the large enterprises loan book had also increased.

Bankers Association of Malawi chief executive officer Lyness Nkungula noted that domestic and global economic agents are now adapting to new ways of doing business to boost economic activity amid the pandemic.

She said in an interview recently: “We have, thus, seen not only a decline in credit default rates, but also an increase in credit demand in recent months.“We expect the trend to continue in the second half of the year.”