Financial sector buoyant, resilient in H1, says RBM

The Reserve Bank of Malawi (RBM) says the financial sector continued to be resilient to global and domestic shocks despite the prolonged impact of the Covid-19 pandemic on the economy.

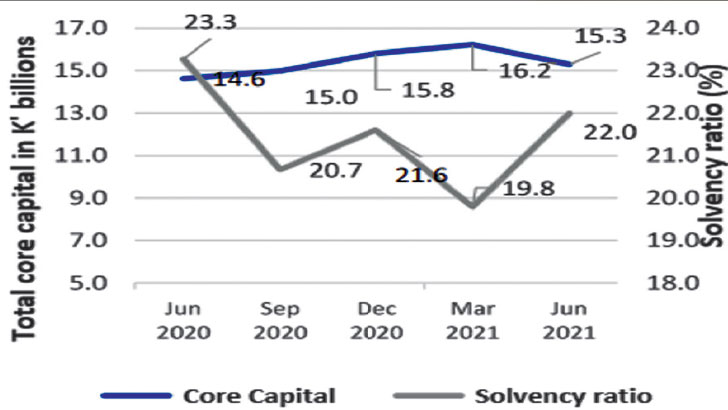

In its latest Financial Stability Report covering January to June this year, RBM said the banking sector remained sound and resilient characterised by adequate capital and increased profitability with sufficient liquidity.

Reads the report in part: “Nonetheless, asset quality slightly deteriorated to 6.6 percent above the recommended regulatory limit of five percent.

“The June 2021 stress-testing results revealed that the banking sector was vulnerable to credit and liquidity risks.”

Financial market analyst Emmanuel Chokani, who is also Bridgepath Capital chief executive officer, said the financial sector has been well capitalised, with diversified investment portfolios and strong risk management in place.

In a written response on Tuesday, he attributed the resilience to the cost of funding for some institutions, which has remained low; hence, providing an adequate buffer for risk-taking.

Chokani said the financial sector also benefited from high government borrowing as it provides a majority of the domestic financing.

He said: “However, this is at the expense of the other private sector players who are crowded out by the government borrowing. Since most of the borrowing is not to finance development projects, economic growth may be subdued.

“Further, the profitability of the other private sector players may deteriorate as their cost of debt financing increases. This may in turn reduce the taxable profits, leading to increased government borrowing to finance further deficits that have been created inadvertently.”

On the other hand, Chokani described the resilience of the financial sector as important because it decreases systemic risk, arguing that the lower the risk in a market, the lower the cost of financing, which means more projects can be undertaken to achieve economic growth.

“The financial sector oils most of the sectors of the economy and is an important fabric of ecosystem of many players. A well-functioning financial sector further attracts foreign direct investment,” he said.

Chokani called for a reduction in government borrowing to provide fiscal space, reduced economic volatility through improving foreign exchange reserves, new product development by the sector, better risk management tools and increased risk appetite as the economy recovers.

Meanwhile, findings of the June 2021 Banking Lending Survey (BLS) showed banks perceived demand for loans and credit lines have increased in the six-month period to June 2021.

Other sectors such as insurance, pension, micro finance and the savings and credit cooperatives (Saccos) also remained resilient despite the effects of the pandemic.

However, micro finance and Saccos asset quality remained a concern as the ratio of non-performing loans to gross loans remained above the acceptable benchmark during the review period.