Icam pleads for fresh tax compliance window

Institute of Chartered Accountants in Malawi (Icam) has asked Treasury to re-introduce the voluntary tax compliance window to cushion businesses from the effects of Covid-19 and facilitate clearance of tax arrears without penalties and interests.

In an interview on Monday after submitting the 2022/23 budget proposal to Ministry of Finance, Icam chief executive officer Francis Chinjoka Gondwe said they want the window extended up to December 31 this year.

Malawi Revenue Authority (MRA) introduced the voluntary compliance window from April to November 2020 to enable businesses affected by the Covid-19 pandemic to pay their tax dues without penalties, interest or any charge.

Gondwe said the window has the potential to relieve businesses that are still reeling from the effects of the pandemic.

He said: “In the same vein, we call for the operationalisation of double taxation agreements [DTAs] with strategic countries, including Mauritius and The Netherlands.

“We also call for the immediate review of the DTA with South Africa, which is out of date, resulting in the country losing out taxes as well as incurring enormous foreign exchange on payments.”

Gondwe said the DTA review should include re-defining industrial and commercial profits based on advancements on incomes globally.

He said given the Covid-19 shocks, Treasury should also consider re-introducing interest rates grace periods sanctioned by the Reserve Bank of Malawi.

Gondwe called for the continued sensitisation of small and medium enterprises on the available tax incentives and benefits of compliance.

He also suggested the intensification of compliance audits that should aim at improving education and the operation of taxes rather than being merely punitive.

Experts says taxation review is critical in ensuring a thriving business environment given economic challenges presented by the Covid-19 pandemic.

Voluntary compliance window is a measure that government instituted to relieve taxpayers from possible shocks of Covid-19.

In an interview on Monday, Blantyre-based tax expert Emmanuel Kaluluma of EK Tax Consultants said voluntary compliance windows act as an incentive for taxpayers.

He said: “These windows are real. Sometimes you have people who have backslided and they have not been paying taxes, so the voluntary tax window comes out and wipe your slate.

“So that is an incentive and those that are willing to be tax compliant take advantage. It is a good measure and initiative.”

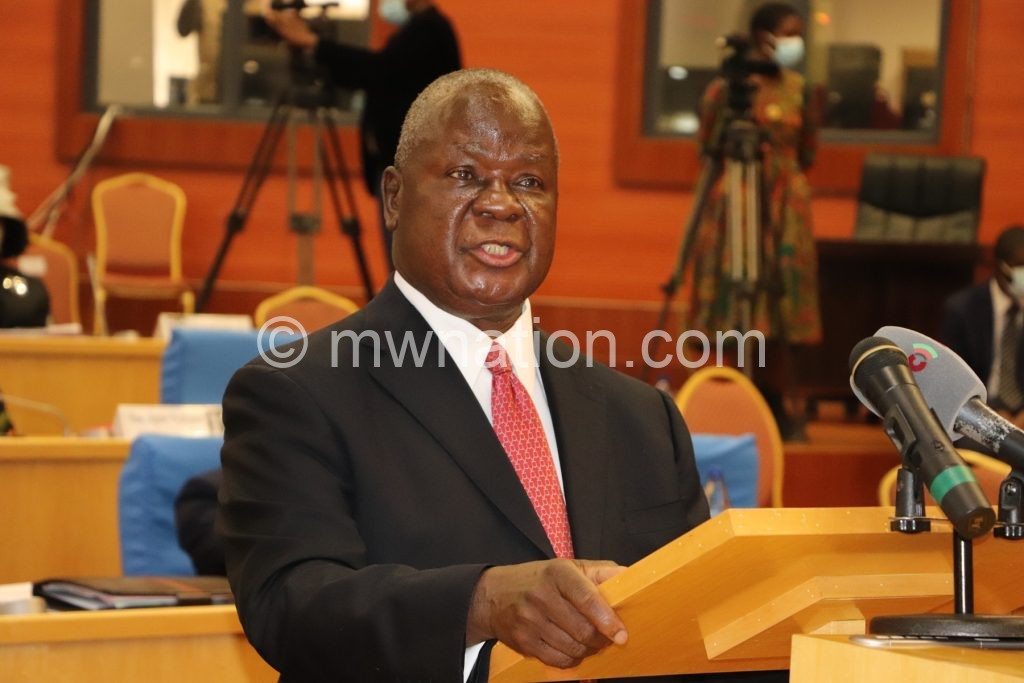

In an earlier interview, Minister of Finance Felix Mlusu who has been soliciting public input for the 2022/23 budget framework to ensure inclusivity, said the ministry has taken note of the proposals and will take on board some of them.

He said: “We will look at the views and ideas that will give us quick-wins in our implementation.

“We will also look at the views and ideas which enable us pluck the low hanging fruits and those that set a foundation to anchor our budget in line with the Malawi 2063.” In the previous voluntary tax compliance window, MRA collected K4.6 billion in tax revenue.