UN exposes gender gaps In financial inclusion

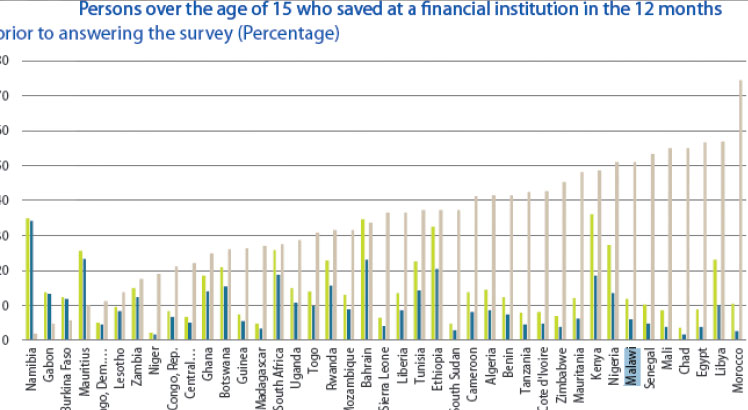

United Nations Economic Commssion for Africa (Uneca) says women in Malawi continue to be disadvantaged in digital financial services access despite being a common tool for modern financial transactions.

The trend, according to the UN agency and industry insiders, could derail the country from achieving meaningful financial inclusion if left unchecked.

The report report titled ‘Digital finance: A pathway to women’s economic empowerment in Africa, observes that in Malawi, the gaps exist in knowledge and understanding of digital financial services among women

Reads the report: “In countries such as Malawi, requisite skills in digital and financial literacy, with only around 12 percent of women possessing digital finance-related information and communications technology skills.

“Generally, the region’s lack of an enabling environment for digital connectivity, with a lower rate of mobile and Internet usage is also an issue of concern for most countries.”

In a statement accompanying the report Uneca gender, poverty and social policy division acting director Edlam Yemeru said that there remains considerable scope to scale up digital finance and ensure that women can take full advantage of the resulting opportunities.

“This requires addressing a number of barriers related to connectivity, digital literacy, cost, laws and culture,” he said.

The report has since recommended strengthening national development policies and plans by ensuring that they contain strategic pillars that focus on information and communications technology (ICT) and social development and by providing gender-sensitive and inclusive policy frameworks and explicitly integrating a gender perspective into national ICT policies.

Meanwhile, a recent report by the Reserve Bank of Malawi (RBM) also indicated that despite rising uptake in electronic payment channels, there is low participation of women in digital financial services.

The National Payments Systems report by the RBM showed that gender imbalance continues to be heavily skewed towards males as women only constitute 38.4 percent of the total subscriber base.

ICT Association of Malawi president Bram Fudzulani is on record as having said there is need concerted efforts to address the gap in ICT uage.

He said: “An organisation should not go in the rural area and only tackle women empowerment issues that leave out digital financial awareness, which have proved to even empower women more when they are made aware of their power and usage.

“Our women inclusion efforts will not be meaningful if we leave out ICT and digital financial mass literacy, especially to the underprivileged communities.”

In its recent Malawi Economic Monitor, the World Bank also indicated that the supply of digital skills is low in the country among Malawians affecting the ability of individuals and businesses to leverage digital public platforms and digital financial services.

According to the bank, a greater enforcement of telecommunications and financial sector regulations is needed to promote competition, protect consumer benefits and stimulate market demand.