World Bank queries revenue targets

The World Bank says the downward revision of revenue targets this fiscal year will unlikely help Treasury to reduce the widening budget deficit.

Minister of Finance, Economic Planning and Development Joseph Mwanamvekha announced the downward revision of domestic revenue target for the 2019/20 fiscal year from K1.43 trillion to K1.35 trillion.

But in a written response on Wednesday, World Bank country manager Greg Toulmin observed that to reach the revised tax revenue target would require tax revenue in the second half to be 44 percent higher than in the first half.

He said this calls for government to proactively manage expenditure within actual revenues to avoid an even higher fiscal deficit and increased domestic borrowing.

Said Toulmin: “Avoiding high deficits and reducing high-cost domestic borrowing is key to improving fiscal management in the medium-term, thus opening the way for increased spending on growth-creating and development activities.

“Malawi’s budget performance in the first half of the fiscal year indicated that revenues and grants were substantially below targets. Our reading of the statement is that this was largely due to over-optimistic revenue assumptions in the approved budget.”

He said in the first half, recurrent expenditure was over-budget while development expenditure underperformed.

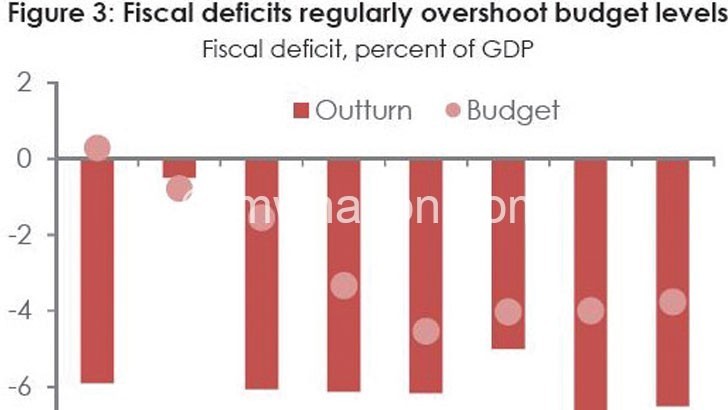

This resulted in a wider than projected deficit of 2.9 percent of gross domestic product (GDP), largely funded by domestic financing, which was more than the target set out in the original budget.

In the first half of this fiscal year, Treasury recorded a budget defict of K165.7 billion largely due to low revenue collection by Malawi Revenue Authority (MRA).

In the Mid-Year Review Budget statement last Friday, Mwanamvekha said of the total domestic revenue, taxes will account for K1.28 trillion while non-tax revenue will amount to K70.4 billion, with grants projected to increase from K150.1 billion to K174.9 billion by the end of the fiscal year on June 30.

Budget figures show that out of domestic revenue target of K655.2 billion, comprising K629.9 billion in tax revenue and K25.2 billion in non-tax revenue, K548.6 billion was collected in the first half.

The underperformance was seen in the tax revenue basket as out of a targeted K629.9 billion for the first-half, K525.6 billion was collected.

Mwanamvekha said the downward revision in tax revenue is mainly on account of the current political environment and delayed implementation of some revenue measures.

In an earlier interview, tax analyst Misheck Msiska, who is also a partner at MM Tax Advisory Services, noted that government is failing to maximase its revenue due to inefficiencies and corruption.

He said government needs to look into the performance of non-tax revenue and come up with long-lasting solutions as poor performance in this revenue line puts pressure on tax revenue targets to be fulfilled by MRA.