Debt service costs rising

Rising external debt is costing Ministry of Finance and Economic Affairs more in servicing the loan, with World Bank figures showing an 83 percent increase in the past five years.

The World Bank data shows that in 2021, Treasury paid K22.5 billion to service external debt, a slight rise from the K21.5 billion paid in the previous year.

The International Debt Report, which is the World Bank’s compilation of statistics covering external debt of 121 low and middle-income countries, shows that in 2019, Treasury paid K17.4 billion in debt service from K12.3 billion in 2018.

In a statement accompanying the report, World Bank Group president David Malpass underscored the need for a comprehensive approach to the debt problem, including debt reduction, swifter restructuring and improved transparency.

He said: “Countries need to facilitate swifter restructuring by focusing on spending that supports growth and reduces poverty.

“Without it, many countries and their governments face a fiscal crisis and political instability, with millions of people falling into poverty.”

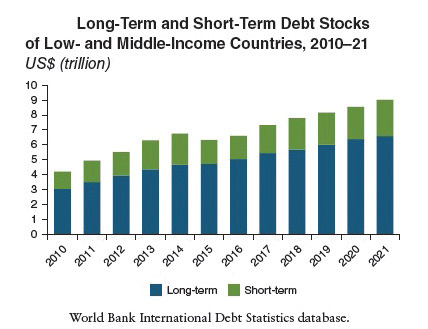

The World Bank data shows that globally, total external debt increased by 5.6 percent in nominal terms to $9 trillion in 2021.

The data further shows that external debt as a share of gross national income declined by three percentage points in 2021 to 26 percent for low and middle-income countries.

Reacting to the report yesterday, Catholic University head of economics Hopkins Kawaye said rising debt service costs could be avoided if government reviews its spending by balancing it with available resources.

He said it is not surprising that debt service costs are going up because government borrowing is becoming unsustainable.

Said Kawaye: “What is critical at this juncture is for the government to implement and put in practice various debt management tools and policies.

“By borrowing heavily, we are only milking the already thin cow that is the country.”

He urged Treasury to close gaps in public finance management tools.

In the current financial year, the Malawi Government is expected to pay K645.2 billion interest on debt, which has increased by K124.5 billion from the approved K520.7 billion, according to Minister of Finance and Economic Affairs Sosten Gwengwe.

He admitted the pressures debt interest is placing on the budget, saying it is affecting budget implementation.

“The reason for over expenditure on public debt interest is due to exchange rate adjustment, resulting from the devaluation of the kwacha and higher interest rates,” said Gwengwe.

In order to offset the impact of these increased expenditure, he indicated that a number of budget lines under other recurrent transactions and development budget have since been revised downwards.

Gwengwe said that the government is looking into ways to deal with debt sustainability.

“We are currently asking our creditors to restructure our debts and they will be sacrificing and giving up millions of dollars,” he said.

The minister said a Multi Donor Trust Fund under the banner Friends of Malawi has been set up where donors are mobilising resources to bail out Malawi.

He said government is striving to optimise budgets to spend prudently and where possible, cut.

Last year, government also indicated that it intends to operationalise the Debt Retirement Fund amid rising public debt.

But Gwengwe said the fund, which will be set up to help retire short-term debt to create fiscal space, seeks to rewind the debt stock through the fund which will be created for the retirement of short-term debt instead of rolling to the next financial year.

Meanwhile, Ministry of Finance and Economic Affairs data shows that as at end September 2022 Malawi’s public debt stock stood at K7.3 trillion, up from K6.38 trillion in March this year, an increase of 14 percent.

Of the total debt debt, external debt accounted for 45 percent or K3.3 trillion while domestic debt accounted for 55 percent or K4 trillion. As a percentage of gross domestic product, the total debt in nominal terms stands at 64 percent.